Municipal Bond Stress Testing

Secure Your Investments in Any Market Condition

SCREEN MUNICIPAL BONDS.

Stress Test your Municipal Bonds in Minutes

Don’t wait for the market to dictate your success.

Take Control of Your Investments Today

Gain unparalleled insights into potential risks and performance under various market conditions.

Insulate your investments form risk hidden below the surface.

BondView’s Stress Testing

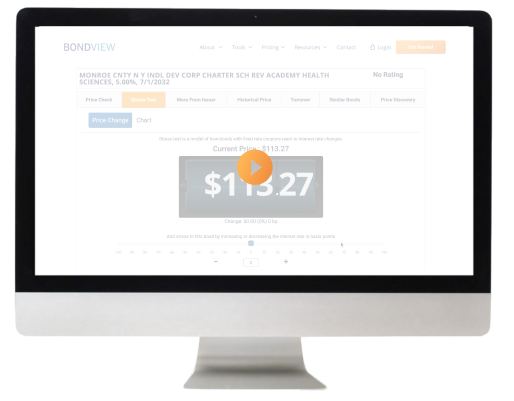

Securely navigate the bond market and shield your investments from risks. Our tool provides comprehensive analysis by x-raying and stress-testing a bond, portfolio, and the entire holdings of a bond fund or ETF, down to the bond level.

It also allows for adaptable testing under various market conditions, particularly interest rate changes, and uses weighted holdings to perform in-depth stress-tests on each bond within a fund.

Portfolio-Level Stress Testing

Try it nowFund-Level Stress Testing

Try it nowBond-Level Stress Testing

Sign up to get startedNot a member yet?

Select Your Plan

Get one month free

BondView Advisors

$69/ month

$759/ year

Subscribe SubscribeIncludes:

- Bond-level Stress Testing

- Portfolio-level Stress Testing

BondView Pro

$120/ month

$1320/ year

Subscribe SubscribeIncludes:

- All in Advisors Plan

- Fund-level Stress Testing

Bank Auditing Compliance

$3600/ year

$3600/ year

Learn More Learn MoreIncludes:

- All in Pro Plan

- Historical Reporting for Compliance

Your are currently on a free plan. Request 7-day Pro Trial to Unlock All Data.

Municipal Bond Insights

Partners

Partnering with industry leaders to deliver key municipal data insights