Top 10 Texas Municipal Bonds for Sale Today

Last Update: October 22nd, 2024

List of Texas Municipal Bonds for Sale

This selection of top Texas municipal bonds for sale today uses Artificial Intelligence to address various aspects such as issuer reputation, investment potential, and the significance of the issuing entities. These bonds are distinguished by their top-tier BondView ratings and credit assessments, which can indicate low default potential and robust fiscal health. The report aims to guide investors in making more informed decisions.

To view all bonds request a free 7-day free trial from BondView.

Access All Top Bonds For Sale Today with BondView

Why These Texas Municipal Bonds Are a Good Investment

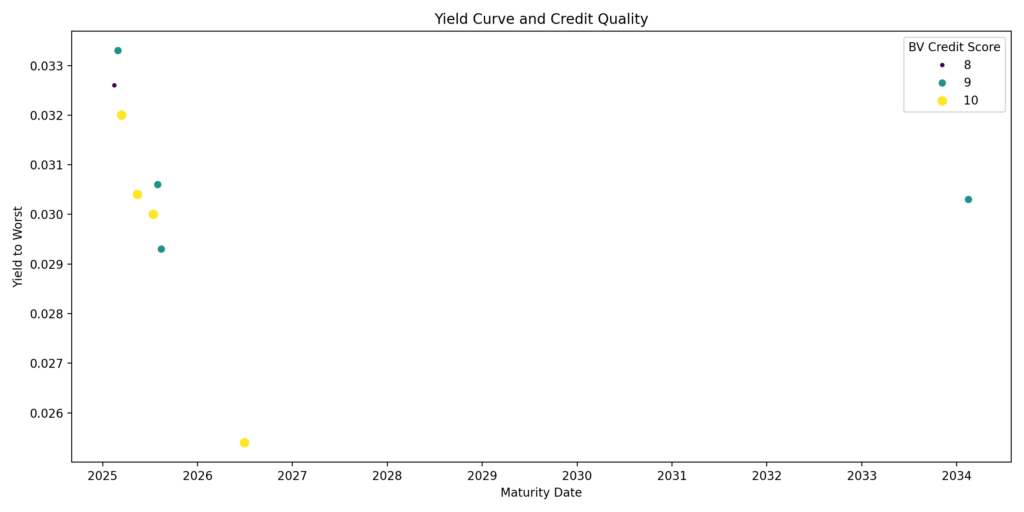

Our analysis of the best Texas municipal bonds for sale reveals a diverse and potentially attractive market for investors. This analysis encompassed 9 bonds, showcasing an average yield to worst of 3.04% and an impressive average BV Credit Score of 9.33 out of 10, indicating generally high credit quality across the board. The bonds offer an average yield spread of 1.04% over the benchmark, with maturities ranging from February 15, 2025, to February 15, 2034, providing options for both short-term and long-term investors.

Interestingly, there’s a moderate negative correlation (-0.4694) between yield to worst and credit scores, suggesting that higher yields may come with slightly increased risk. The market offers a spectrum of opportunities, from the El Paso Water and Sewer Revenue bond with the highest yield spread of 1.33% to the University of Texas System bond with the lowest at 0.54%. This variety allows investors to tailor their portfolios based on their risk appetite and investment goals within the Texas municipal bond market.

Insured Status Summary

These Texas municipal bonds are not insured, which is typical for high-quality municipal bonds. While insurance adds an extra layer of security, the high credit quality of these bonds suggests they are already low-risk investments. This reassures those looking to buy Texas bonds that they are investing in safe assets.

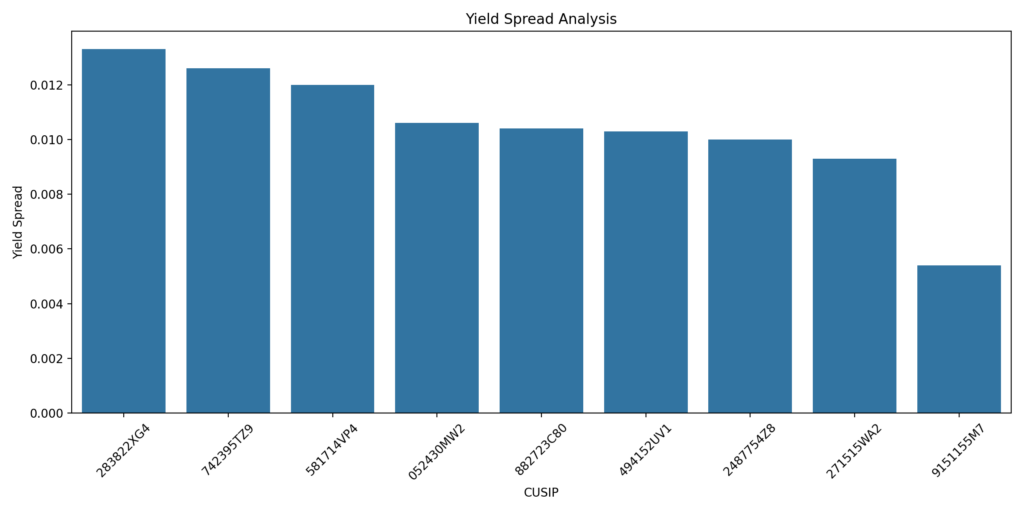

Yield Spread Analysis

When evaluating Texas municipal bonds rates, the yield spread is a key factor to consider. The yield spread analysis below shows the yield spreads for each texas municipal bond relative to a benchmark yield of 2%.

| CUSIP | Yield to Worst | Yield Spread |

|---|---|---|

| 283822XG4 | 0,0333 | 0,0133 |

| 742395TZ9 | 0,0326 | 0,0126 |

| 581714VP4 | 0,032 | 0,012 |

| 052430MW2 | 0,0306 | 0,0106 |

| 882723C80 | 0,0304 | 0,0104 |

| 494152UV1 | 0,0303 | 0,0103 |

| 2487754Z8 | 0,03 | 0,01 |

| 271515WA2 | 0,0293 | 0,0093 |

| 9151155M7 | 0,0254 | 0,0054 |

This graph illustrates the yield spread of each bond over a benchmark yield, highlighting which bonds offer higher returns relative to the benchmark. Texas municipal bonds with higher bars are more attractive as they provide a greater yield spread.

The yield spread analysis shows that the bonds offer a positive yield spread over the benchmark, indicating potential for higher returns relative to risk.

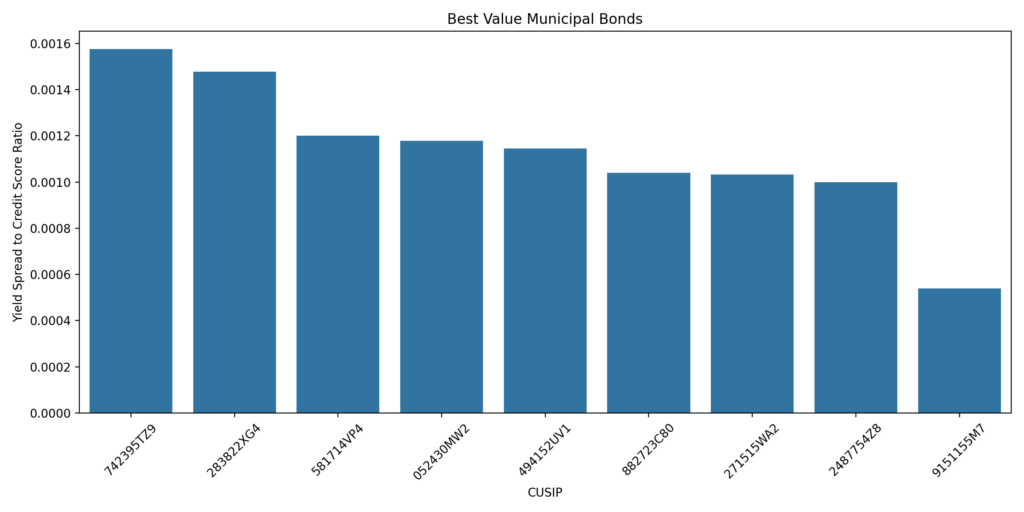

Best Value Texas Municipal Bonds (Highest Yield Spread to Credit Score Ratio):

Some of the best opportunities in the Texas municipal bond market are those offering high yields relative to their credit score. Here are some options for investors:

| CUSIP | Yield Spread | Bv Credit Score | Yield Spread to Credit Ratio |

|---|---|---|---|

| 742395TZ9 | 0,0126 | 8 | 0,001575 |

| 283822XG4 | 0,0133 | 9 | 0,001477778 |

| 581714VP4 | 0,012 | 10 | 0,0012 |

| 052430MW2 | 0,0106 | 9 | 0,001177778 |

| 494152UV1 | 0,0103 | 9 | 0,001144444 |

| 882723C80 | 0,0104 | 10 | 0,00104 |

| 271515WA2 | 0,0093 | 9 | 0,001033333 |

| 2487754Z8 | 0,01 | 10 | 0,001 |

| 9151155M7 | 0,0054 | 10 | 0,00054 |

This graph shows the yield spread to credit score ratio for each municipal bond, identifying which texas municipal bonds offer the best value by providing the highest yield relative to their credit risk. Higher bars indicate better value.

Princeton Independent School District bond (CUSIP: 742395TZ9) offers the best value in terms of yield spread relative to its credit score, followed by the El Paso Water & Sewer Revenue bond (CUSIP: 283822XG4).

Yield Curve and Credit Quality

Understanding the relationship between yield, time to maturity, and credit quality is essential when investing in Texas municipal bonds. This scatter plot displays the relationship between the maturity dates and yields of the bonds, with color and size indicating credit quality. It helps visualize how yield varies with maturity and credit score.

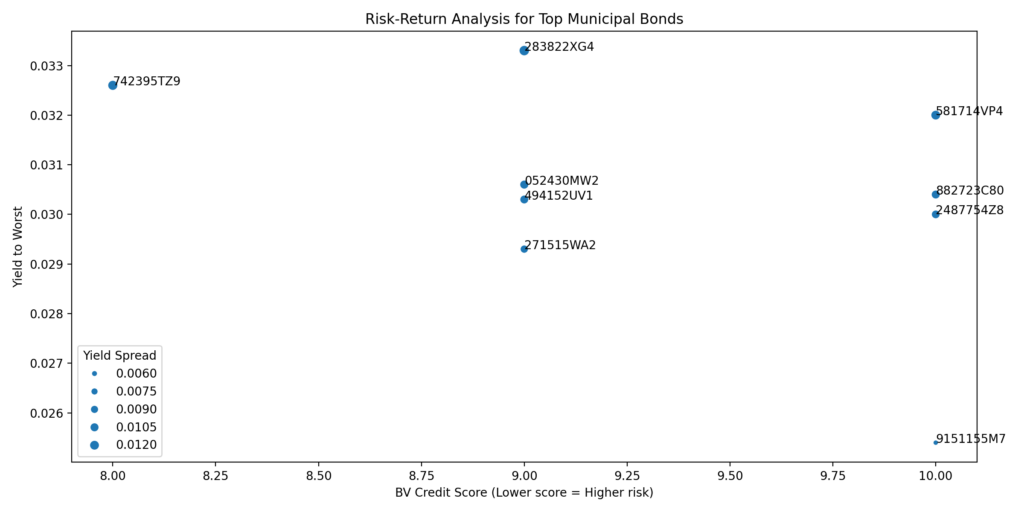

Risk-Return Analysis for Texas Municipal Bonds

This graph plots the yield to worst against the credit score, with bubble size representing yield spread. It provides insights into the risk-return profile of each of the best municipal bonds in texas, helping investors assess potential returns against credit risk.

Standout Bond:

The standout texas municipal bond identified is the “EL PASO TEX WTR & SWR REV REF & IMPT” (CUSIP: 283822XG4), which offers the highest yield spread among the analyzed bonds, indicating a potentially attractive investment due to its favorable yield relative to its credit score.

Based on the risk-return analysis, let’s evaluate the implications of the bond’s credit score on its risk profile and potential returns:

- Credit Score Implications:

- The standout bond has a BV Credit Score of 9, which is relatively high (scale typically ranges from 1-10).

- This high credit score suggests a lower risk of default, indicating the issuer (El Paso Water and Sewer) is considered financially stable.

- The lower risk profile typically corresponds to lower yields, but in this case, the bond offers the highest yield in the sample.

- Yield Analysis:

- Yield to Worst: 3.33%

- This yield is at the top of the range (2.54% – 3.33%) and above both the average (3.04%) and median (3.04%) yields.

- The bond’s yield spread of 1.33% is significant, especially considering its high credit score.

- Risk-Return Trade-off:

- The standout bond offers an attractive risk-return profile, providing the highest yield with a strong credit score.

- This combination suggests a potentially undervalued bond or could indicate some specific risk factors not captured by the credit score alone.

Investment Considerations

When considering Texas municipal bonds for sale, investors should evaluate several factors to ensure they are making informed decisions. These bonds offer various benefits, but there are key considerations to keep in mind:

- Attractive Yield Spreads: All bonds offer positive yield spreads over the benchmark, ranging from 0.93% to 1.33%.

- High Credit Quality: Most bonds have high BV Credit Scores (8-10), indicating low default risk.

- Short to Medium-Term Maturities: Majority of bonds mature between 2025-2026, offering a balance of yield and interest rate risk.

- Best Value Opportunities: Bonds like CUSIP 742395TZ9 and 283822XG4 offer the highest yield spread to credit score ratios.

- Tax Advantages: As municipal bonds, they likely offer tax-exempt income for many investors.

Potential Risks

- Interest Rate Risk: If rates rise, bond prices may fall, especially for longer-term bonds.

Limited Liquidity: Some bonds have low quantities available, which may affect liquidity.

Credit Risk: While minimal, there’s always some risk of default or credit rating changes.

Reinvestment Risk: For shorter-term bonds, there’s a risk of reinvesting at lower rates upon maturity.

Market Risk: General economic conditions in Texas could affect bond performance.

Consider real-time texas municipal bonds rates and values before making any investment decisions.

Texas Municipal Bonds: Issuer Information

Investing in Texas municipal bonds provides opportunities for tax-free income and portfolio diversification. Here’s a detailed look at the financial health and ratings of their issuers:

Purpose: El Paso provides essential municipal services to its residents.

Financial Outlook: As of August 31, 2023, El Paso’s total assets and deferred outflows exceeded its liabilities by $718.9 million in net position. However, the city faces substantial liabilities related to post-employment and pension benefits, contributing to a deficit in unrestricted net position. Investors in El Paso municipal bonds should consider this when evaluating credit risk.

Purpose: PISD focuses on delivering public education to students in Princeton, Texas.

Financial Potential: For the 2024-2025 school year, PISD has adopted a $144.6 million budget, reflecting a 15.36% increase in expenditures. While the district’s tax rate has decreased, rising property values have led to higher average tax bills, impacting fiscal performance. This may influence the appeal of Princeton ISD municipal bonds for investors.

Purpose: McKinney manages municipal services, including infrastructure development, public safety, and community services.

Purpose: AISD delivers public education to Austin students.

Financial Outlook: Facing a $78 million deficit for the 2024-2025 fiscal year, AISD has proposed a Voter Approved Tax Rate Election (VATRE) to help cover staff pay raises and reduce the shortfall. Despite these financial challenges, Austin ISD bonds may still offer value due to their long-term prospects and educational importance.

State of Texas

Purpose: The state oversees a wide range of services, including education, transportation, healthcare, and economic development.

Purpose: KISD provides education to students in Killeen and surrounding areas.

Financial Outlook: Despite a 2.8% budget deficit for 2024-2025, KISD has implemented measures to manage its finances by using fund balances and making strategic cuts. Killeen ISD bonds could still be attractive to investors who are comfortable with school district-backed investments.

Purpose: Denton County provides essential county-level services.

Financial Outlook: While specific financial details are limited, Denton County remains focused on long-term growth and capital improvements. Investors should monitor Denton County municipal bonds for opportunities aligned with these goals.

Purpose: East Central ISD serves the educational needs of students in Bexar County, Texas.

Board of Regents of the University of Texas System

Purpose: Governing the University of Texas System, this board manages multiple educational institutions across the state, offering higher education and research opportunities.

For Investors & Analysts

Keep Your Broker Honest: Your broker might not always inform you about the best bonds for sale. With BondView, you get better information than your broker.

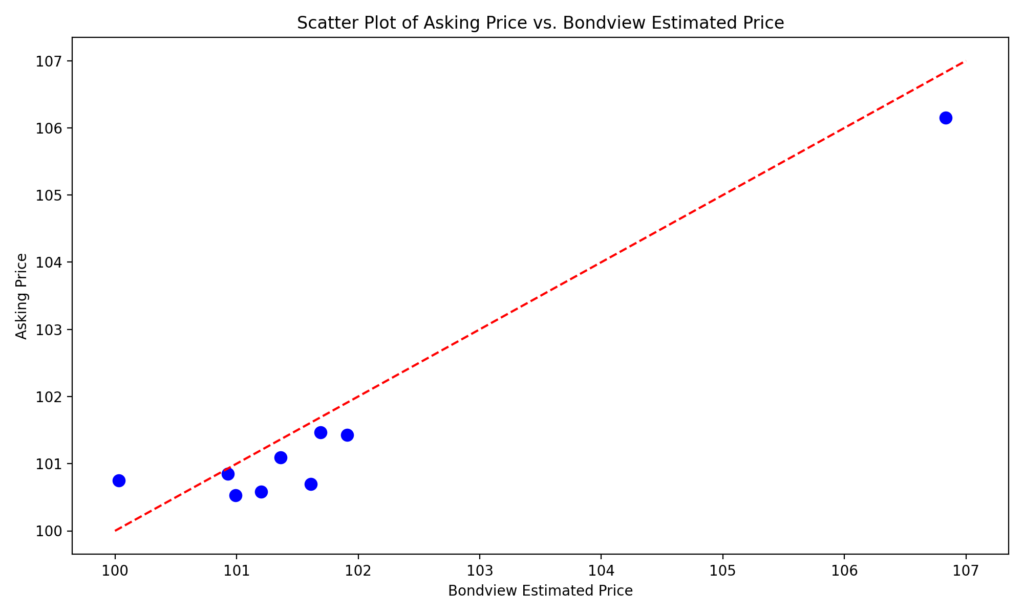

Verify a Muni Bond Quote: Check the accurate price of a bond your broker suggests. Compare your estimated price against real-time asking prices.

Gauge Ease of Buying or Selling a Bond: BondView offers three liquidity indicators, showing bond demand based on fund activity. Assess public and BondView portfolio activities.

This list is updated every 2 months.

This list of Texas municipal bonds for sale is current as of October 22, 2024. For real-time information, use BondView as your guide. A quick CUSIP entry or advanced search reveals details such as interest rates, coupon rates, maturity dates, recent trade prices, and credit ratings.

Note: As with any investment, the market value may vary during the period the investment is held. This article is informational only and does not a substitute for professional financial advice. Please check with your financial advisor before making any investments. Subject to prior sale and market conditions as of 10/22/24.