Top 10 New York Municipal Bonds for Sale

List of New York Municipal Bonds for Sale

This selection of top New Nork municipal bonds for sale today uses AI to address various aspects such as issuer reputation, investment potential, and the significance of the issuing entities. These bonds are distinguished by their top-tier BondView ratings and credit assessments, which can indicate low default potential and robust fiscal health. The report aims to guide investors in making more informed decisions.

To view all bonds request a free 7-day free trial from BondView.

| CUSIP | Name | Quantity Available | Maturity Date | Yield to Worst | Coupon | Insured | Asking Price | Bondview Estimated Price | Bondview Rating | BV Credit Score | Funds |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 01212PEW2 | ALBANY CNTY N Y VARIOUS PURP-SER A | 25 | 06/01/2033 | 2.28% | 4% | No | $108.83 | $105.26 | 4 | 9 | 0 |

| 0313038Q6 | AMHERST N Y PUB IMPT | 125 | 10/15/2036 | 2.29% | 4% | No | $109.35 | $104.54 | 4 | 9 | 0 |

| 031645HW7 | AMITYVILLE N Y UN FREE SCH DIST | 35 | 06/15/2030 | 2.65% | 5% | No | $112.04 | $111.77 | 4 | 8 | 0 |

| 031645JD7 | AMITYVILLE N Y UN FREE SCH DIST | 5 | 06/15/2037 | 2.46% | 4% | No | $107.92 | $103.53 | 4 | 8 | 0 |

| 031303X39 | TOWN OF AMHERST, ERIE COUNTY, NEW YORK PUBLIC IMPROVEMENT SERIAL BONDS-2014 (NY) | 10 | 11/01/2033 | 3.49% | 3.13% | No | $97.25 | $0.00 | 4 | 8 | 0 |

| 031303X47 | TOWN OF AMHERST, ERIE COUNTY, NEW YORK PUBLIC IMPROVEMENT SERIAL BONDS-2014 (NY) | 25 | 11/01/2034 | 3.52% | 3.25% | No | $97.75 | $0.00 | 4 | 8 | 0 |

Last Update: September 11, 2024

Access All Top Bonds For Sale Today in Real-Time

Why Invest in New York Municipal Bonds

New York municipal bonds offer a stable and attractive investment option, especially for those seeking tax-exempt income. These bonds are generally issued by various state and local government entities in New York to finance public projects.

In this article, we will examine the key factors to consider when investing in New York municipal bonds, including yield analysis, credit quality, pricing, and overall investment potential. We’ll also provide a detailed breakdown of their current performance.

Yield Analysis

A detailed yield analysis of available New York municipal bonds reveals the following key insights:

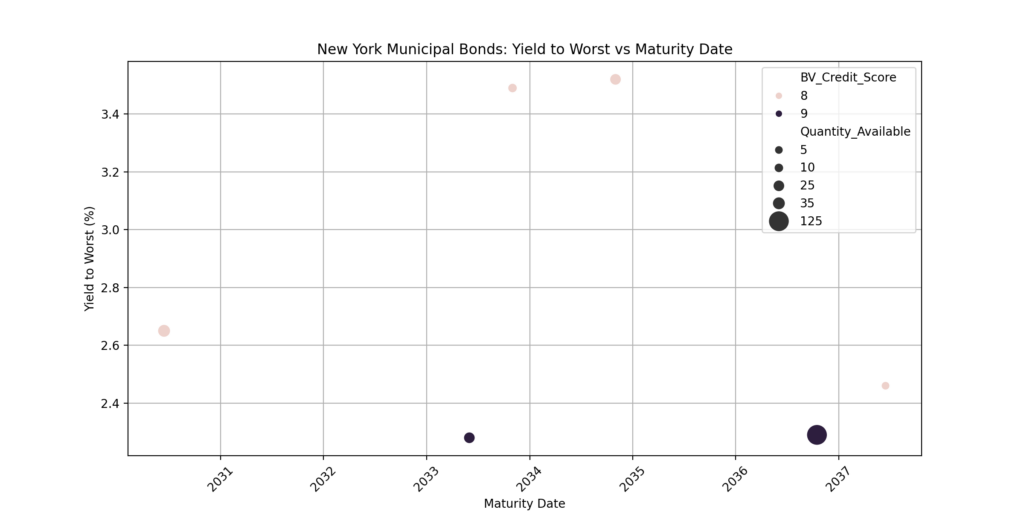

- Yields range: 2.28% to 3.52%

- Average yield: 2.78%

- Highest yields: Amherst Erie County bonds (3.49% and 3.52%)

- Lower yields: Albany County and Amherst NY Public Improvement bonds (~2.28%-2.29%)

Credit Quality of New York Municipal Bonds for Sale

Credit quality analysis shows:

Two bonds maintain top BV Credit Score of 9 (Albany County and Amherst NY Public)

Four bonds have BV Credit Score of 8 (Amityville and Amherst Erie County)

All bonds carry a Bondview Rating of 4

Notably, this is the first time a list of New York municipal bonds for sale features a BondView rating of 4, as no bonds currently achieve a rating of 5. According to BondView no New York Municipal Bonds for sale today offer a BondView rating of 5.

You can review the significance of each BondView Market Implied Rating here.

Yield Spread Analysis

Yield spread analysis helps investors identify which bonds offer the best value in terms of additional yield relative to others in the set. The table below shows the yield spread for each bond, based on the lowest-yielding bond in the analysis.

| Name | Yield to Worst | Yield Spread | BV Credit Score |

|---|---|---|---|

| ALBANY CNTY N Y VARIOUS PURP-SER A | 2,28 | -1,72 | 9 |

| AMHERST N Y PUB IMPT | 2,29 | -1,71 | 9 |

| AMITYVILLE N Y UN FREE SCH DIST | 2,65 | -2,35 | 8 |

| AMITYVILLE N Y UN FREE SCH DIST | 2,46 | -1,54 | 8 |

| TOWN OF AMHERST, ERIE COUNTY, NEW YORK PUBLIC IMPROVEMENT SERIAL BONDS-2014 (NY) | 3,49 | 0,36 | 8 |

| TOWN OF AMHERST, ERIE COUNTY, NEW YORK PUBLIC IMPROVEMENT SERIAL BONDS-2014 (NY) | 3,52 | 0,27 | 8 |

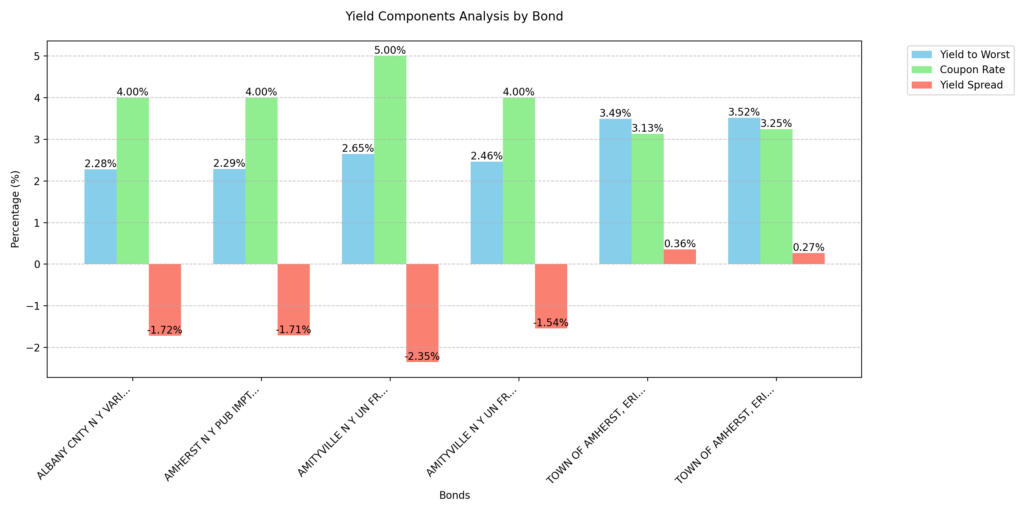

Analyzing the yield spread (Yield to Worst minus Coupon) reveals interesting patterns:

Key observations:

- Most bonds show negative yield spreads.

- Amherst Erie County bonds demonstrate positive yield spreads (0.27% and 0.36%).

- Largest negative spread: Amityville bonds (-2.35%).

Municipal Bond Pricing: Finding Undervalued Opportunities

Our analysis identified several potentially undervalued bonds among New York municipal bonds:

| Name | Asking Price | Bondview Estimated Price | Yield to Worst | Price Difference |

|---|---|---|---|---|

| ALBANY CNTY N Y VARIOUS PURP-SER A | 108,83 | 105,26 | 2,28 | 3,57 |

| AMHERST N Y PUB IMPT | 109,35 | 104,54 | 2,29 | 4,81 |

| AMITYVILLE N Y UN FREE SCH DIST | 112,04 | 111,77 | 2,65 | 0,27 |

| AMITYVILLE N Y UN FREE SCH DIST | 107,92 | 103,53 | 2,46 | 4,39 |

Amityville school district bond shows minimal price premium ($0.27)

Albany County and Amherst NY bonds trade at moderate premiums

Two Amherst Erie County bonds lack current price estimates but offer highest yields

Risk-Return Profile:

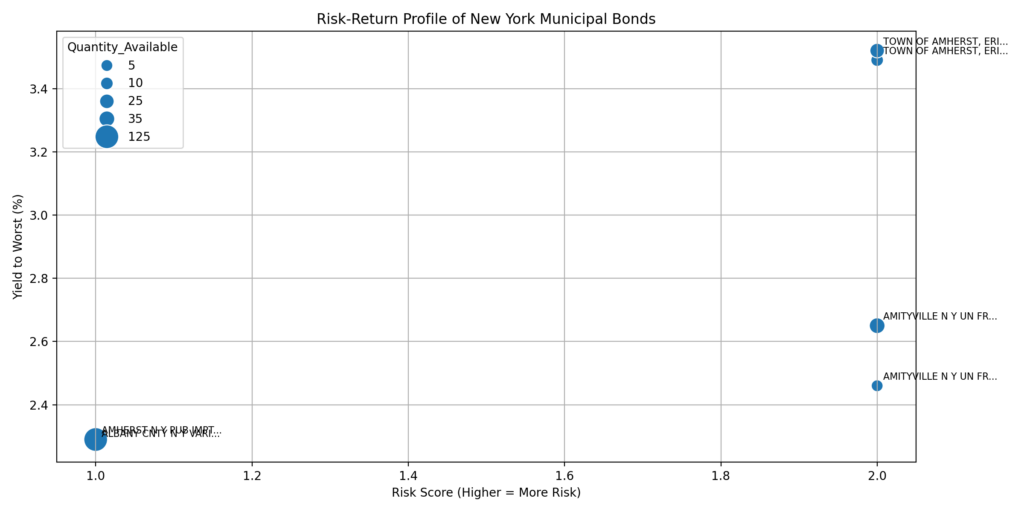

The risk-return profile analysis showcases the following insights:

- Highest risk-adjusted return: Amherst NY Public Improvement bond (2.29%).

- Lowest risk-adjusted return: Amityville bonds due to higher price risk and lower yields.

- Balanced opportunity: Albany County bond offers a good balance of yield and low risk

This scatter plot shows the relationship between risk (x-axis) and return (y-axis). Larger points represent higher quantities available, and annotations highlight bond names.

Investment Considerations for New York Municipal Bonds in 2024

Investing in New York municipal bonds offers several benefits, especially for those in higher tax brackets:

- Tax Benefits: The tax-exempt status of municipal bonds makes them particularly appealing for investors seeking to reduce their tax liabilities.

- Safety: These bonds generally have high credit quality, reducing the risk of default.

- Diversification: New York municipal bonds represent different regions and sectors, providing some diversification benefits.

- Liquidity: While municipal bonds can be less liquid, their short-term nature helps enhance liquidity in many cases.

However, there are some risks to consider:

Yield-Quality Trade-off: Risk premium approximately 0.2-1.2% for lower-rated bonds

- Higher-rated bonds (Score 9) yield 2.28-2.29%

- Lower-rated bonds (Score 8) offer enhanced yields of 2.46-3.52%

Maturity Structure: Yield curve shows positive slope, favoring longer-term investments

- Shortest maturity: 2030 (Amityville)

- Longest maturity: 2037 (Amityville)

Liquidity Profile: Most bonds have moderate lot sizes (25-35 bonds)

- Largest block: Amherst NY (125 bonds)

- Smallest block: Amityville (5 bonds)

Price Considerations: Price premiums generally align with credit quality

- Premium bonds: Most trade above par

- Discount bonds: Amherst Erie County series (97.25-97.75)

In conclusion, New York municipal bonds offer a compelling mix of yield, safety, and tax advantages, making them ideal for conservative investors. However, potential buyers should carefully consider their financial situation and risk tolerance before committing. Diversifying across multiple bonds or exploring municipal bond funds may also be prudent strategies for 2024.

New York Municipal Bonds: Issuer Information

- Albany County, New York

- Amityville Union Free School District, New York

- Town of Amherst, Erie County, New York

For Investors & Analysts

Keep Your Broker Honest

Your broker may not reach out to you proactively about bonds for sale and may not know all your options. With BondView, you can rest assured that you have the same or better information than your broker.

Verify A Muni Bond Quote

Get an accurate price for a bond that your broker has pitched. Verify your own estimated price against its real-time asking price.

Gauge Ease Of Buying Or Selling A Bond

BondView provides 3 liquidity indicators in this report. See how in demand a bond is based on the funds that hold this bond and their buy/sell activity. Do the same for public and BondView portfolios.

This list is updated every 2 months.

This list of New York municipal bonds for sale is current as of November 28, 2024. For real-time information, use BondView as your guide. A quick CUSIP entry or advanced search reveals details such as interest rates, coupon rates, maturity dates, recent trade prices, and credit ratings.

Note: As with any investment, the market value may vary during the period the investment is held. This article is informational only and does not a substitute for professional financial advice. Please check with your financial advisor before making any investments. Subject to prior sale and market conditions as of 11/28/24.