Top 10 California Municipal Bonds for Sale

List of California Municipal Bonds for Sale

This selection of top 10 California municipal bonds for sale today uses Artificial Intelligence to address various aspects such as issuer reputation, investment potential, and the significance of the issuing entities. These bonds are distinguished by their top-tier BondView ratings and credit assessments, which can indicate low default potential and robust fiscal health. The report aims to guide investors in making more informed decisions.

Only 6 municipal bonds for sale in California met the criteria this month.

To view all bonds request a free 7-day free trial from BondView.

Scroll to the right over the table for full view.

| CUSIP | Name | Quantity Available | Maturity Date | Yield to Worst | Coupon | Insured | Asking Price | Bondview Estimated Price | Bondview Rating | BV Credit Score | Held in Funds |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 378394GX2 | GLENDALE COMMUNITY COLLEGE DISTRICT (LOS ANGELES COUNTY, CALIFORNIA) ELECTION OF 2016 GENERAL OBLIGATION BONDS, SERIES A (CA) | 10 | 08/01/2041 | 2.64% | 5.25% | No | $106.57 | $107.42 | 5 | 9 | 3 |

| 13048T8A4 | CALIFORNIA MUNICIPAL FINANCE AUTHORITY REVENUE BONDS (POMONA COLLEGE) SERIES 2017 (CA) | 30 | 01/01/2048 | 2.61% | 4% | No | $104.03 | $104.35 | 5 | 10 | 1 |

| 13033WLA9 | CALIFORNIA INFRASTRUCTURE & ECONOMIC DEV BK REV BAY AREA TOLL BRDGS-1ST LIEN-A (CA)* | 105 | 07/01/2033 | 2.45% | 5% | Yes | $107.42 | $108.37 | 5 | 10 | 5 |

| 13067WRV6 | CALIFORNIA ST DEPT WTR RES CENT VY PROJ REV SER BB | 50 | 12/01/2028 | 2.40% | 5% | No | $109.75 | $110.21 | 5 | 10 | 4 |

| 13067WSH6 | CALIFORNIA ST DEPT WTR RES CENT VY PROJ REV WTR SYS-SER BD | 50 | 12/01/2028 | 2.36% | 5% | No | $109.91 | $110.66 | 5 | 10 | 1 |

| 13033WKY8 | CALIFORNIA INFRASTRUCTURE & BAY AREA TOLL BRDGS-1ST LIEN-A | 45 | 07/01/2026 | 2.35% | 5% | Yes | $100.2 | $104.43 | 5 | 10 | 1 |

Last Updated: September 32, 2024

Access All Top Bonds For Sale Today with BondView

Why Invest in California Municipal Bonds?

Investing in California municipal bonds for sale could present a solid opportunity for those seeking a balance of safety and income. These bonds are known for their high credit quality and consistent income generation, making them an attractive option for both seasoned and new investors.

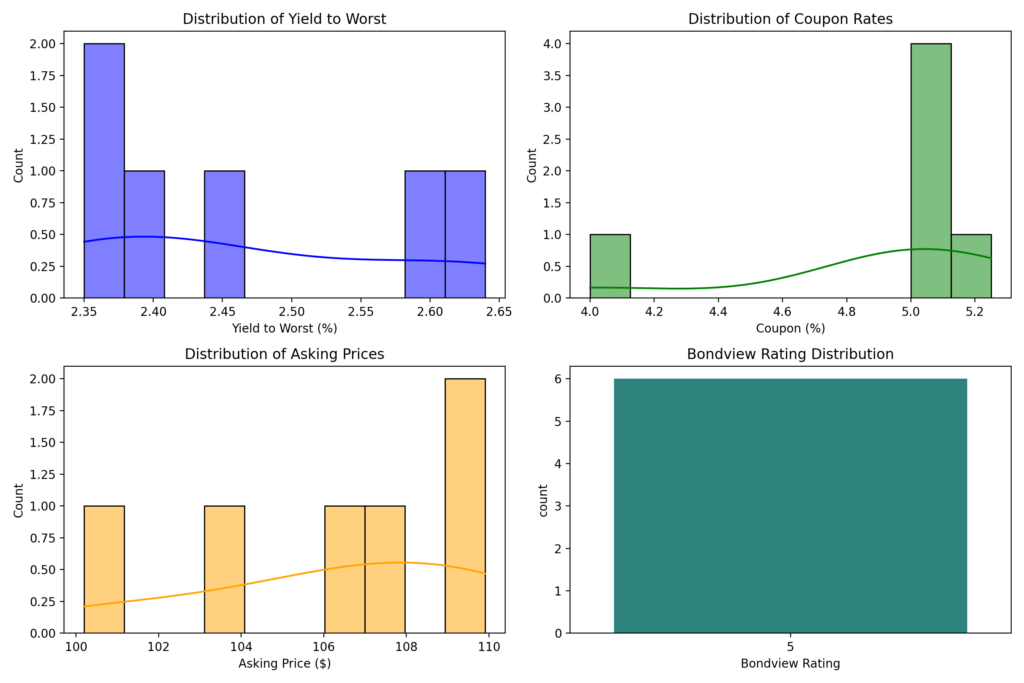

Summary Statistics

| Yield to Worst | Coupon | Asking Price | Bondview Estimated Price | Bondview Rating | BV Credit Score | |

|---|---|---|---|---|---|---|

| count | 6 | 6 | 6 | 6 | 6 | 6 |

| mean | 2,468333333 | 4,875 | 106,3133333 | 107,5733333 | 5 | 9,833333333 |

| std | 0,126714903 | 0,440170422 | 3,70469252 | 2,735256234 | 0 | 0,40824829 |

| min | 2,35 | 4 | 100,2 | 104,35 | 5 | 9 |

| 25% | 2,37 | 5 | 104,665 | 105,1775 | 5 | 10 |

| 50% | 2,425 | 5 | 106,995 | 107,895 | 5 | 10 |

| 75% | 2,57 | 5 | 109,1675 | 109,75 | 5 | 10 |

| max | 2,64 | 5,25 | 109,91 | 110,66 | 5 | 10 |

Here’s why these bonds stand out:

- Top Credit Quality: Most bonds have a BV Credit Score of 9 or 10, reflecting robust financial stability and minimal default risk. This makes them some of the best California municipal bonds for sale today.

- All bonds have the highest BondView rating (5/5)

- Attractive Yields: Yields range from 2.35% to 2.64%, providing consistent returns, particularly for tax-conscious investors.

- Premium Pricing: While most bonds trade at a premium (above $100), their high credit quality and competitive yields justify the pricing.

- Insurance Protection: Two of the bonds in this selection are insured, offering additional security for risk-averse investors.

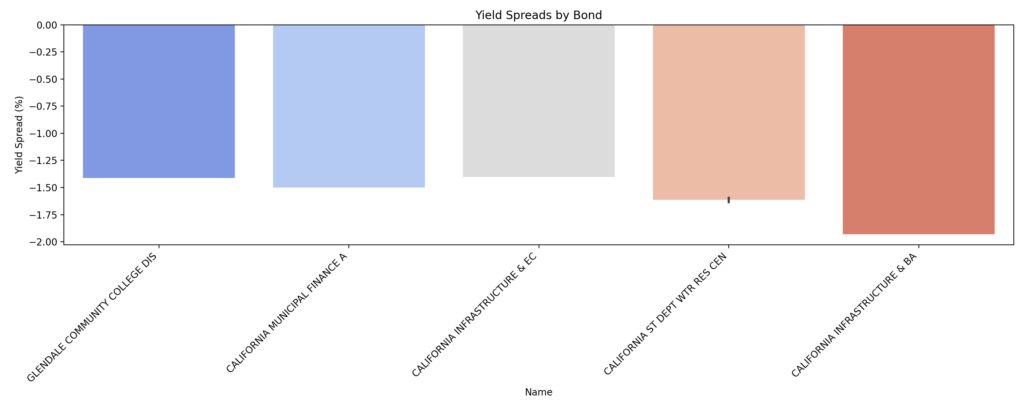

Yield Spread Analysis

When evaluating California muni bond rates, the yield spread is a key factor to consider. Below is a breakdown of some noteworthy California bonds and their respective yield spreads:

The California Infrastructure & Economic Development Bank bond offers the highest yield spread, reflecting its strong risk-adjusted return potential.

Key Yield Insights:

- Average Yield Spread: -1.58%

- Spread Range: 0.53%

- Yield Range: 2.35% to 2.64%

These negative spreads indicate that these bonds yield slightly less than comparable Treasuries due to their high credit quality and tax advantages.

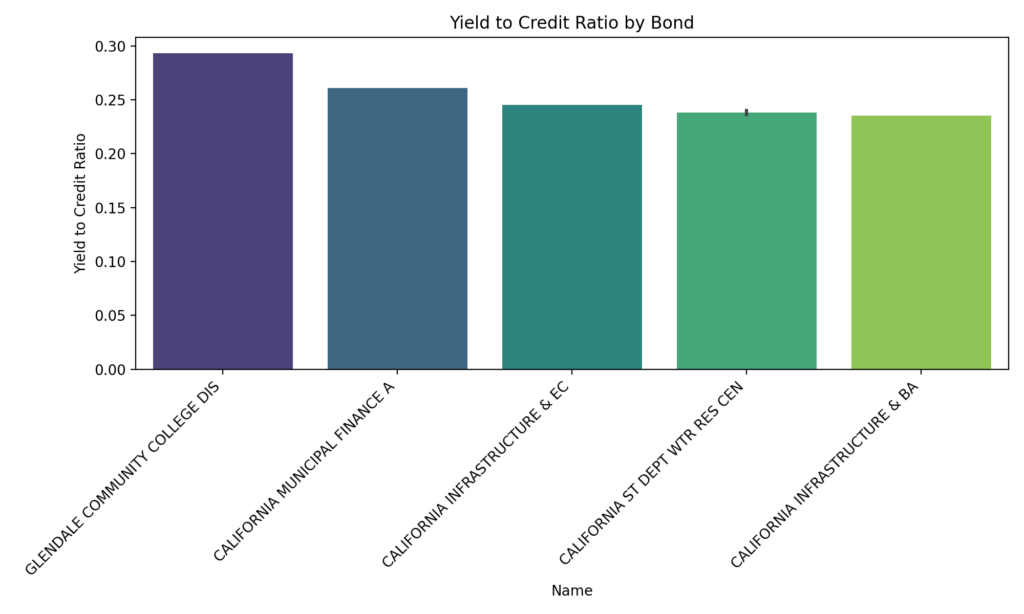

Best Value California Municipal Bonds (Highest Yield Spread to Credit Score Ratio):

Some of the best opportunities in the California municipal bond market are those offering high yields relative to their credit score. Here are some options for investors:

| Name | Yield to Worst | BV Credit Score | Yield to Credit Ratio |

|---|---|---|---|

| GLENDALE COMMUNITY COLLEGE DISTRICT (LOS ANGELES COUNTY, CALIFORNIA) ELECTION OF 2016 GENERAL OBLIGATION BONDS, SERIES A (CA) | 2,64 | 9 | 0,293333333 |

| CALIFORNIA MUNICIPAL FINANCE AUTHORITY REVENUE BONDS (POMONA COLLEGE) SERIES 2017 (CA) | 2,61 | 10 | 0,261 |

| CALIFORNIA INFRASTRUCTURE & ECONOMIC DEV BK REV BAY AREA TOLL BRDGS-1ST LIEN-A (CA)* | 2,45 | 10 | 0,245 |

| CALIFORNIA ST DEPT WTR RES CENT VY PROJ REV SER BB | 2,4 | 10 | 0,24 |

| CALIFORNIA ST DEPT WTR RES CENT VY PROJ REV WTR SYS-SER BD | 2,36 | 10 | 0,236 |

| CALIFORNIA INFRASTRUCTURE & BAY AREA TOLL BRDGS-1ST LIEN-A | 2,35 | 10 | 0,235 |

Among the top California municipal bonds, the Glendale Community College District bond stands out with the highest yield-to-credit ratio.

- Yield to Worst: 2.64%

- BV Credit Score: 9

- Yield to Credit Ratio: 0.2933

This bond offers the highest yield-to-credit ratio of 0.2933, meaning it provides the most yield per unit of credit risk. While it has a slightly lower credit score (9 vs 10 for the others), it compensates with a higher yield (2.64%), making it the most efficient choice from a risk-adjusted yield perspective.

This makes it one of the best California municipal bonds for investors seeking high returns with relatively low credit risk.

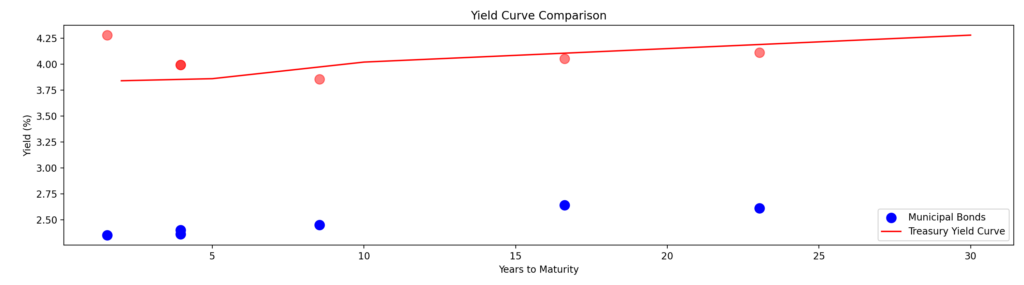

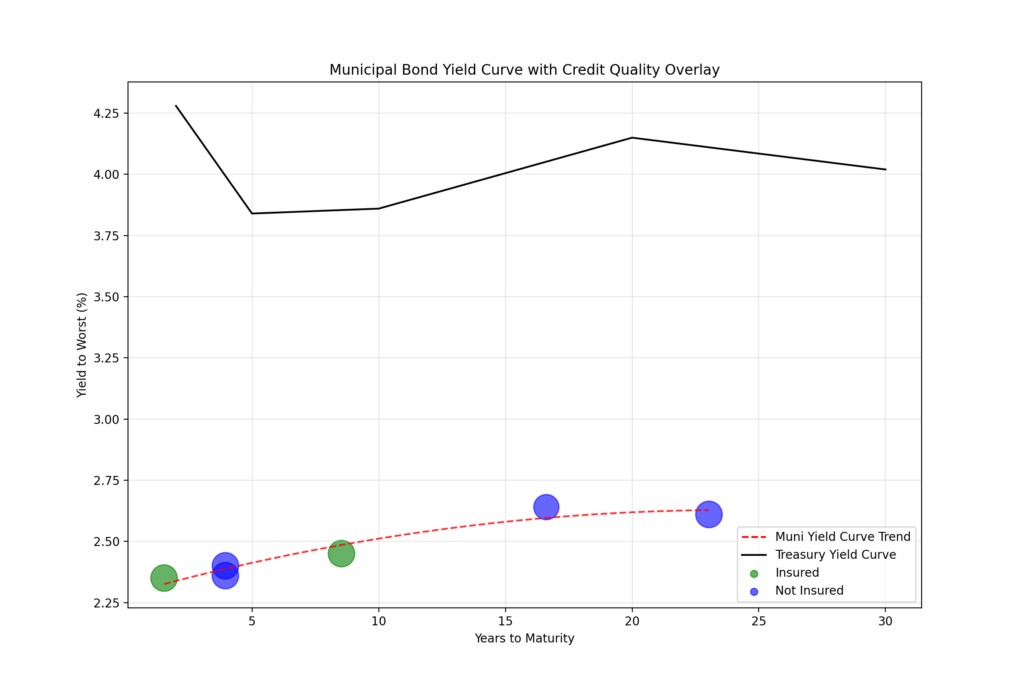

Yield Curve and Credit Quality

Understanding the relationship between yield, time to maturity, and credit quality is essential when investing in California municipal bonds.

Yield by Maturity Segment:

| mean | count | std | |

|---|---|---|---|

| 0-5 years | 2.37 | 3 | 0.026 |

| 5-10 years | 2.45 | 2 | NULL |

| 10-15 years | NULL | 0 | NULL |

| 15-25 years | 2.625 | 2 | 0.021 |

The yield curve shows a downward trend in risk premiums, with insured bonds offering slightly lower yields. Bonds with higher credit scores (10) generally yield less, reflecting their lower risk.

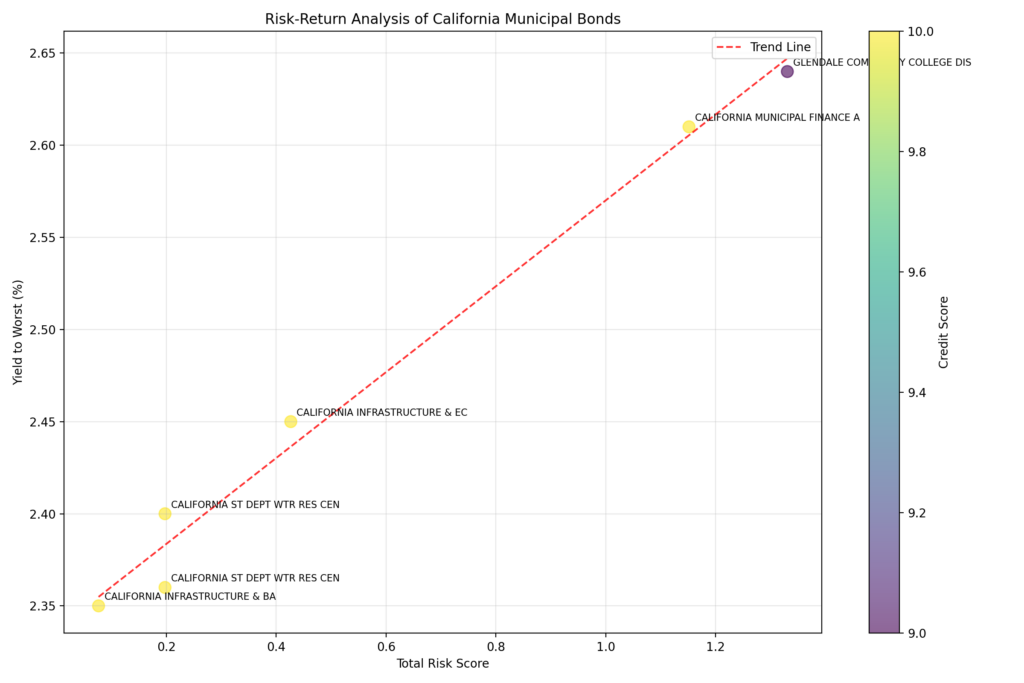

Risk-Return Analysis for California Municipal Bonds

The scatter plot illustrates the relationship between risk and return, with bonds labeled for clarity. Below are the results:

- Average Yield: 2.468%

- Yield Standard Deviation: 0.127%

- Yield Range: 2.350% – 2.640%

The bond with the highest yield-to-risk ratio is the California Infrastructure & Bay Area Toll Bridges bond, indicating it offers the best return relative to its risk.

Key Takeaways of the Risk-Return Analysis of California Municipal Bonds

The average yield for these California municipal bonds for sale is 2.468%, with a standard deviation of 0.127%, indicating relatively low variability in yields across the bonds analyzed. This suggests a consistent return profile for these bonds.

- Risk-Adjusted Returns: California Infrastructure & Bay Area Toll Bridges bond shows the highest yield-to-risk ratio (30.71). Shorter duration bonds generally demonstrate better risk-adjusted returns

- Yield Stability: Tight yield range (2.35% – 2.64%) ensures predictable income.

- High Credit Scores: All bonds analyzed have BV Credit Scores of 9 or 10, indicating exceptional fiscal health.

- Insurance Options: Two bonds offer insurance protection, reducing risk for conservative investors.

- Tax Advantages: At a 35% federal tax rate, tax-equivalent yields range from 3.62% to 4.06%, making these bonds competitive with taxable alternatives.

Investment Considerations

When considering California municipal bonds for sale, investors should evaluate several factors to ensure they are making informed decisions. These bonds offer various benefits, but there are key considerations to keep in mind:

- Yield Range: The California municipal bonds offer yields ranging from 2.48% to 3.00%, with an average yield of approximately 2.62%.

- Credit Quality: The bonds maintain high credit quality, with BV Credit Scores ranging from 8 to 10 (on a scale where higher is better). Investors seeking the best California municipal bonds can rely on these high-credit ratings for confidence in their investments.

- Short-Term Maturities: These bonds have relatively short-term maturities, with all bonds maturing between October 2024 and August 2025. This reduces interest rate risk but may require reinvestment sooner.

- Premium Pricing: Most of the California muni bonds for sale are currently trading at a premium (above par value), with asking prices ranging from $100.03 to $102.12.

Standout Bond: The MONTEREY CNTY CALIF CTFS PARTN REF-PUB FACS bond (CUSIP: 612448PH7) stands out with the highest yield (3.00%) and a favorable yield-to-credit ratio, among the best california municipal bonds available.

Issuer Financial Health Analysis

Glendale California Community College

Type: Education

Revenue Source: Property Tax

Credit Strength: Strong tax base, growing enrollment

California Municipal Finance Authority (Pomona College)

Type: Higher Education

Revenue Source: College Revenue

Credit Strength: Large endowment, selective admission

California Infrastructure & Economic Dev Bank

Type: Infrastructure

Revenue Source: Toll Revenue

Credit Strength: Essential infrastructure, stable tolls

California State Dept Water Resources

Type: Water Resources

Revenue Source: Water System Revenue

Credit Strength: Critical water system, state backing

All issuers have strong financial backing, with revenue sources tied to essential services like property taxes, tolls, and water systems.

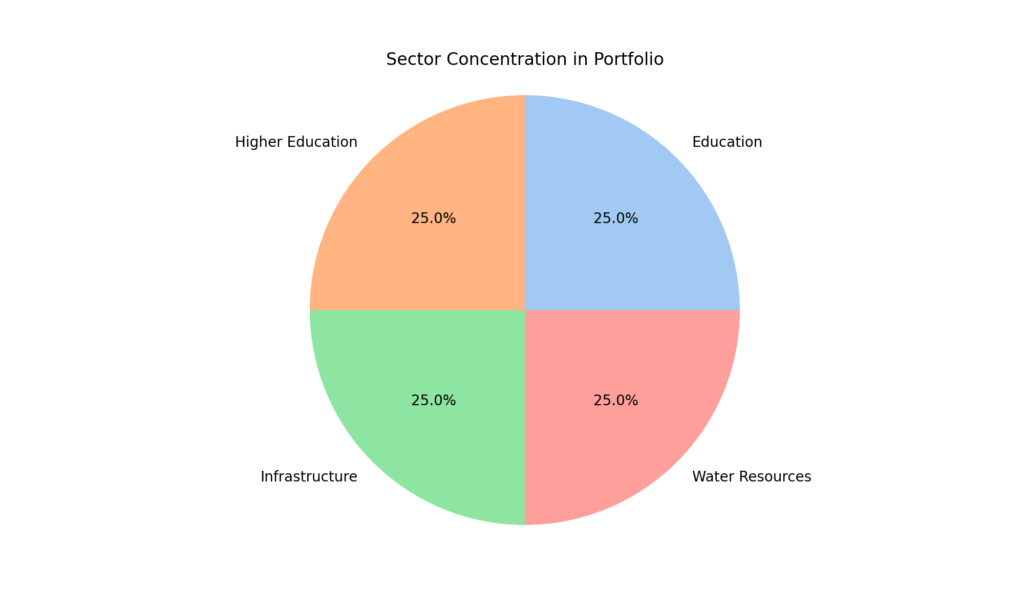

Sector Concentration

The best California Municipal Bonds currently available for sale are evenly distributed across four sectors: Education, Higher Education, Infrastructure, and Water Resources, each contributing 25%.

Based on the comprehensive market conditions, tax implications, and liquidity analysis, here are the key investment considerations:

Credit Quality and Safety

- All bonds have strong credit scores (9-10)

- Essential service providers with stable revenue streams

- State backing for water resources adds security

Portfolio Construction

- Perfect sector diversification (25% each)

- Mix of tax-backed and revenue-backed bonds

- Range of maturities provides laddering opportunities

Risk-Adjusted Returns

- Glendale Community College offers highest yield (2.64%)

- Bay Area Toll Bridges shows best yield-to-risk ratio

- Insured bonds provide additional safety with minimal yield sacrifice

Market Position

- All yields currently below Treasury curve

- Strong California economy supports tax-backed bonds

- Essential services (water, education) provide recession resistance

Potential Risks

Duration Risk:

- Longer-dated bonds (15-25 years) offer higher yields (2.625%).

- Short-term bonds (0-5 years) provide more stable returns with average yield of 2.37%.

Liquidity Risk:

- Higher education and water bonds typically have better secondary market liquidity

- Infrastructure bonds may have limited trading volume

Interest Rate Risk:

- Longer-duration bonds (Pomona College, Glendale) have higher interest rate sensitivity

- Consider laddering maturities to manage interest rate risk

Call Risk:

- Review call provisions, especially for higher-yielding bonds

- Consider call-protected bonds for more predictable income streams

For Investors & Analysts

Keep Your Broker Honest

Your broker may not reach out to you proactively about bonds for sale and may not know all your options. With BondView, you can rest assured that you have the same or better information than your broker.

Verify A Muni Bond Quote

Get an accurate price for a bond that your broker has pitched. Verify your own estimated price against its real-time asking price.

Gauge Ease Of Buying Or Selling A Bond

BondView provides 3 liquidity indicators in this report. See how in demand a bond is based on the funds that hold this bond and their buy/sell activity. Do the same for public and BondView portfolios.

This list is updated every 2 months.

This list of California municipal bonds for sale is current as of December 19, 2024. For real-time information, use BondView as your guide. A quick CUSIP entry or advanced search reveals details such as interest rates, coupon rates, maturity dates, recent trade prices, and credit ratings.

As with any investment, the market value may vary during the period the investment is held. This article is informational only and does not a substitute for professional financial advice. Please check with your financial advisor before making any investments. Subject to prior sale and market conditions. Price as of 12/19/24.