Top 10 Florida Municipal Bonds for Sale

List of Municipal Bonds for Sale

This selection of top florida municipal bonds for sale today uses Artificial Intelligence to address various aspects such as issuer reputation, investment potential, and the significance of the issuing entities. These bonds are distinguished by their top-tier BondView ratings and credit assessments, which can indicate low default potential and robust fiscal health. The report aims to guide investors in making more informed decisions. This month, only 3 municipal bonds met the top criteria.

To view all bonds request a free 7-day free trial from BondView. Scroll to the right over the table for full view.

| CUSIP | Name | Quantity Available | Maturity Date | Yield to Worst | Coupon | Insured | Asking Price | Bondview Estimated Price | Bondview Rating | BV Credit Score | Funds |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 593241BK7 | CITY OF MIAMI BEACH, FLORIDA WATER AND SEWER REVENUE AND REVENUE REFUNDING BONDS, SERIES 2017 (FL) | 150 | 09/01/2026 | 3% | 5% | No | $103.44 | $103.88 | 5 | 9 | 1 |

| 790420NG4 | ST. JOHNS COUNTY, FLORIDA WATER AND SEWER REVENUE AND REFUNDING BONDS, SERIES 2016 (FL) | 20 | 06/01/2025 | 3.17% | 5% | No | $100.96 | $101.75 | 5 | 9 | 0 |

Access All Top Bonds For Sale Today

with BondView

Why Invest in Florida Municipal Bonds

Investing in Florida municipal bonds offers several compelling benefits, especially for those seeking stable, tax-advantaged returns. Here’s why they are an attractive option for investors:

Tax Benefits: Interest income from Florida municipal bonds is generally exempt from federal income tax and, in many cases, from state taxes.

Stability: These bonds are considered relatively safe investments, as they are backed by the taxing power of municipalities. Florida’s strong credit ratings and diversified economic base enhance the reliability of these bonds.

Income: With coupon rates often exceeding 5%, Florida muni bonds provide a steady stream of income through regular interest payments, making them an excellent option for income-focused portfolios.

Diversification: Adding municipal bonds in Florida to your investment portfolio can help reduce overall risk by diversifying your asset allocation.

Florida’s Economic Growth: Florida’s robust economic fundamentals, coupled with no state income tax, create a favorable environment for municipal bonds. The state’s population growth, thriving tourism industry, and expanding infrastructure investments support long-term stability.

Summary Statistics

- Bond Type: Water and sewer revenue bonds

- Coupon Rates: 5% for both bonds

- Prices: Trading at premium levels ($103.44 and $100.96)

- Credit Ratings: High Bondview Credit Score indicating strong creditworthiness

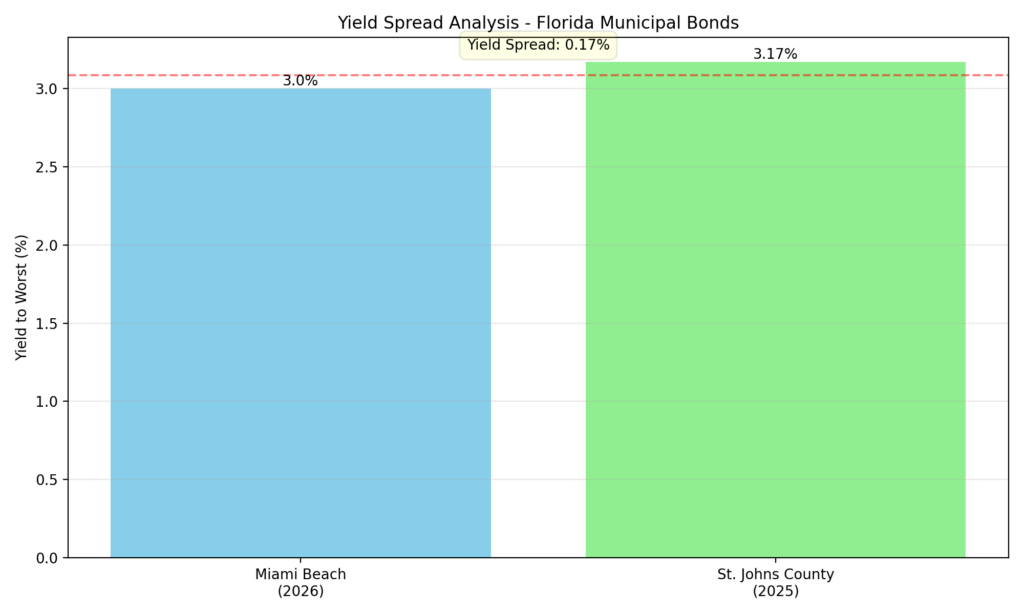

Yield Spread Analysis of Florida Municipal Bonds

When investing in Florida municipal bonds for sale, analyzing the yield spread is crucial. Below is a breakdown of some key bonds and their yield spreads:

Key Yield Metrics

- Average Yield: 3.08%

- Absolute Yield Spread: 0.17%

- Relative Yield Differential: 5.51%

These metrics suggest competitive Florida municipal bonds interest rates and favorable market positioning, despite recent material events.

Key Yield Metrics

- Spread Direction: The St. Johns County bond offers a higher yield (3.17%) despite its shorter maturity (2025). This may reflect slightly higher perceived risk or specific market positioning.

- Spread Magnitude: The modest 17-basis-point spread (5.51% relative yield differential) indicates similar risk profiles for both bonds. Investors evaluating Florida state bonds should consider these competitive yield metrics.

- Market Context: Both bonds offer yields that are competitive within the municipal bonds in Florida market. However, the inverse relationship between maturity and yield is unusual and may signal unique risk-return dynamics.

Best Value Florida Muni Bonds (Highest Yield Spread to Credit Score Ratio):

Some of the best opportunities in the Florida municipal bonds market are those offering high yields relative to their credit score.

There are only two bonds this month and they both represent the best value florida municipal bonds.

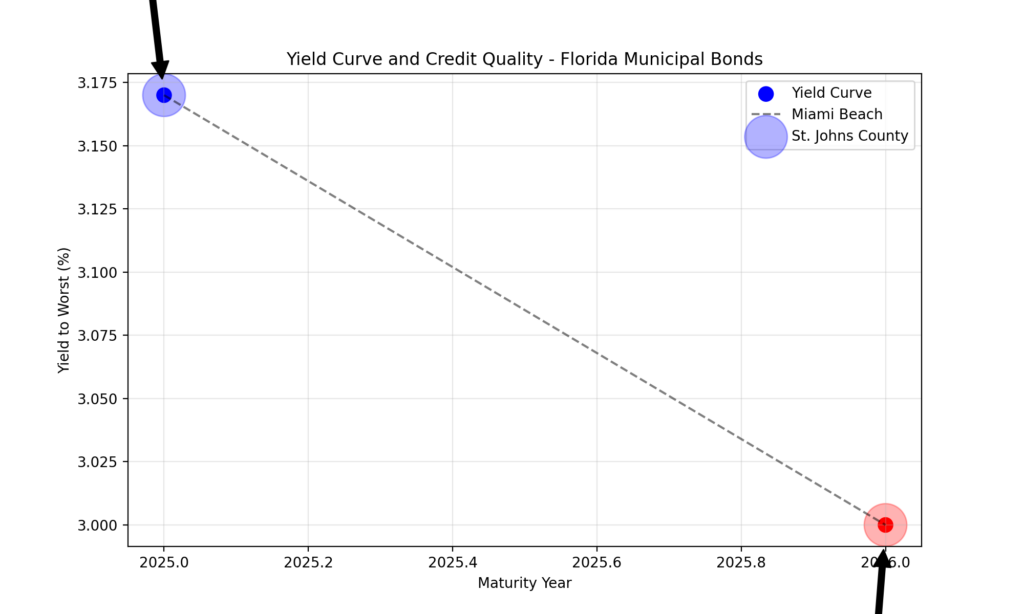

Yield Curve and Credit Quality

The yield curve for Florida municipal bonds illustrates how bond yields increase as time to maturity lengthens, with credit quality being a key determinant of the returns. Municipal Bonds with shorter maturities and higher credit scores tend to offer lower yields, reflecting their lower risk.

By analyzing this curve, investors can identify bonds that offer an ideal balance between yield and credit quality, matching their risk tolerance.

- St. Johns County Bond: 3.17% yield (2025 maturity)

- Miami Beach Bond: 3.00% yield (2026 maturity)

- Slope of Yield Curve: -0.170% per year

- Average Yield: 3.08%

- Yield Range: 3.00% – 3.17%

Both bonds maintain high credit scores of 9, reinforcing their status as low-risk investments in Florida muni bonds.

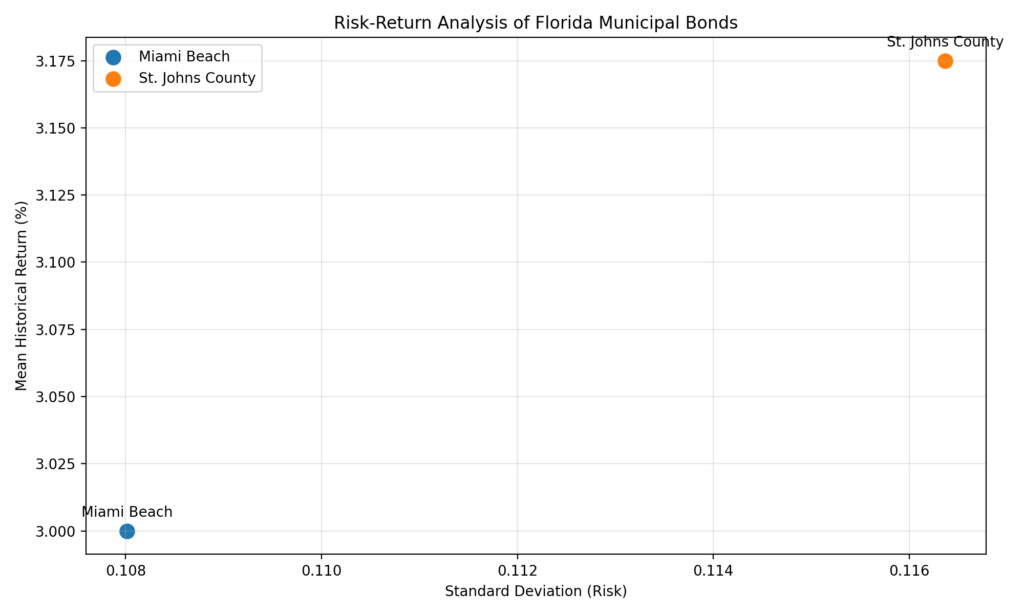

Risk-Return Analysis: Florida Municipal Bonds

The “Risk-Return Analysis” is a valuable tool for investors, as it provides insights into how much yield they can expect based on the credit quality of the bonds they are considering. By understanding this relationship, investors can make more informed choices that align with their financial goals and risk tolerance.

This visualization plots the yield to worst against credit quality, emphasizing the trade-off between credit risk and yield:

Key Components of the Risk-Return Analysis of Florida Municipal Bonds

Miami Beach Bond

- Standard Deviation: 0.108

- Mean Historical Return: 3.00%

- Current Yield: 3.00%

- Sharpe Ratio: 9.26

St. Johns County Bond

- Standard Deviation: 0.1164

- Mean Historical Return: 3.175%

- Current Yield: 3.17%

- Sharpe Ratio: 10.10

Interpreting the Risk-Return Trade-off

The St. Johns County bond offers higher returns with slightly more risk, while the Miami Beach bond provides stability and consistent returns. Both options showcase strong risk-adjusted performance, making them top-tier choices for investors seeking Florida municipal bonds.

Making Investment Decisions

- Investors who are risk-averse may prefer Florida municipal bonds with higher credit scores, even though they might have lower yields. This offers more security with reduced risk.

- On the other hand, risk-seeking investors might opt for bonds with lower credit scores to capture higher yields, accepting the increased risk that comes with those investments.

Investment Considerations in Florida Municipal Bonds

- Credit Quality: High ratings (Bondview 5, credit score 9)

- Yield Analysis: Competitive 5% coupons with yields to worst of 3.00%-3.17%

- Market Dynamics: Premium prices reflect strong demand and fair valuation

- Duration and Maturity: Short maturities (2025-2026) minimize interest rate risk

Potential Risks

- Marketing Risks:

- Interest rate fluctuations can impact bond prices.

- Premium prices may result in capital loss if held to maturity.

Geographic Risks: Florida faces natural disaster risks, including hurricanes, which may impact infrastructure-backed bonds.

- Liquidity Risks: Limited availability (20-150 bonds) could restrict trading in secondary markets.

Despite these risks, municipal bonds in Florida remain high-quality investments backed by strong municipalities and essential infrastructure services.

That being said, significant events have impacted Florida and Florida municipal bonds in the past months. Transforming this top 10 list into a top 2 list. It’s important to have those in consideration before making an investment decision.

Hurricane Impact: Hurricanes Helene and Milton struck Florida in late September and early October, respectively. These storms put approximately $30 billion of municipal debt at risk, including bonds financing critical infrastructure like hospitals, utilities, and senior living facilities.

Credit Watch: S&P Global Ratings has placed some Florida utilities on negative credit watch due to potential hurricane damage, emphasizing the importance of analyzing geographic risks before investing in Florida muni bonds.

Bond Buyback Initiative: In mid-October, Florida announced its first-ever bond buyback program, offering to repurchase approximately $500 million of its $33 billion in outstanding debt. This includes about $165 million in turnpike enterprise debt, $90 million in right-of-way bonds, and $245 million in public education bonds.

Market Concerns: The back-to-back hurricanes have raised investor concerns about purchasing bonds in storm-prone areas, potentially affecting the Florida municipal bond market.

Sector-Specific Risks: The healthcare and senior living sectors have the most outstanding municipal debt at risk from Hurricane Milton, at $9.9 billion, followed by appropriation and tax-backed debt ($5.6 billion) and education and cultural institutions ($4.7 billion).

Long-term Implications: Climate change concerns are expected to lead to higher costs for Florida communities, potentially impacting future infrastructure investments and debt issuance.

Potential for Early Redemptions: Some municipal bonds backed by Florida-based obligors are facing optional redemption risk due to the recent hurricanes, which could lead to early bond redemptions if severe damage is confirmed.

Florida Municipal Bonds: Issuer Information

City of Miami Beach, Florida

- Primary Revenue Source: Parking Revenue

The bond is backed by Miami Beach’s growing tourism industry, which recorded a 13% increase in domestic visitors from 2021 to 2023. The resulting growth in parking revenue supports the bond’s strong credit profile.

Saint Johns County

St. Johns County issues bonds primarily to:

- Fund improvements to its water and sewer infrastructure

- Refinance existing debt related to water and sewer projects

- Achieve debt service savings

- Net revenues of the St. Johns County Utility System: These florida municipal bonds are secured by a pledge of the net revenues from the county’s water and sewer system

- Water and sewer rates: The primary revenue source comes from monthly water, wastewater, and reclaimed water rates charged to customers

- Exclusions: Pledged funds do not include net revenues on deposit in the rebate fund or connection charges on deposit in the stabilization account.

Disaster Preparedness and Recovery:

- Miami Beach is considering an insurance policy for resort tax revenue to mitigate the impact of events like hurricanes and economic downturns.

- The state is assessing the impact of recent hurricanes (Helene and Milton) on municipal bonds and infrastructure.

Financial Outlook:

Positive Factors:

- Florida maintains a AAA credit rating and has one of the lowest tax burdens in the country.

- The state has reserves exceeding $17 billion and has reduced over one-third of its total tax-supported debt.

- Revenue collections have exceeded expectations by approximately $1.1 billion.

Challenges:

- Climate-related risks, including hurricanes, pose ongoing threats to municipal bonds and infrastructure.

- St. Johns County School District faces funding challenges due to restricted revenue-raising capabilities despite property value growth.

- Rising costs, including inflation and increased teacher salaries, are putting pressure on school district budgets.

Market Conditions:

- The municipal bond market is entering 2024 with stable credit fundamentals and supportive demand/supply dynamics.

- Low Municipal/Treasury ratios and compressed credit spreads are observed.

- Ratings upgrades have outpaced downgrades, and default rates remain low.

Future Considerations:

- State and local government fundamentals may weaken modestly in 2024 due to wage pressures, slowing revenue, and unexpected migration.

- Climate change and federal risks remain relevant secular trends.

- The municipal market size remains stagnant, but demand is likely to outpace supply in the near term.

For Investors & Analysts

Keep Your Broker Honest: Your broker might not always inform you about the best bonds for sale. With BondView, you get better information than your broker.

Verify a Muni Bond Quote: Check the accurate price of a bond your broker suggests. Compare your estimated price against real-time asking prices.

Gauge Ease of Buying or Selling a Bond: BondView offers three liquidity indicators, showing bond demand based on fund activity. Assess public and BondView portfolio activities.

This list is updated every 2 months.

This list of Florida municipal bonds for sale is current as of November 21, 2024. For real-time information, use BondView as your guide. A quick CUSIP entry or advanced search reveals details such as interest rates, coupon rates, maturity dates, recent trade prices, and credit ratings.

As with any investment, the market value may vary during the period the investment is held. This article is informational only and does not a substitute for professional financial advice. Please check with your financial advisor before making any investments. Subject to prior sale and market conditions. Price as of 11/21/24.