BondView Announces Interest Rate Stress Test For Municipal Bonds

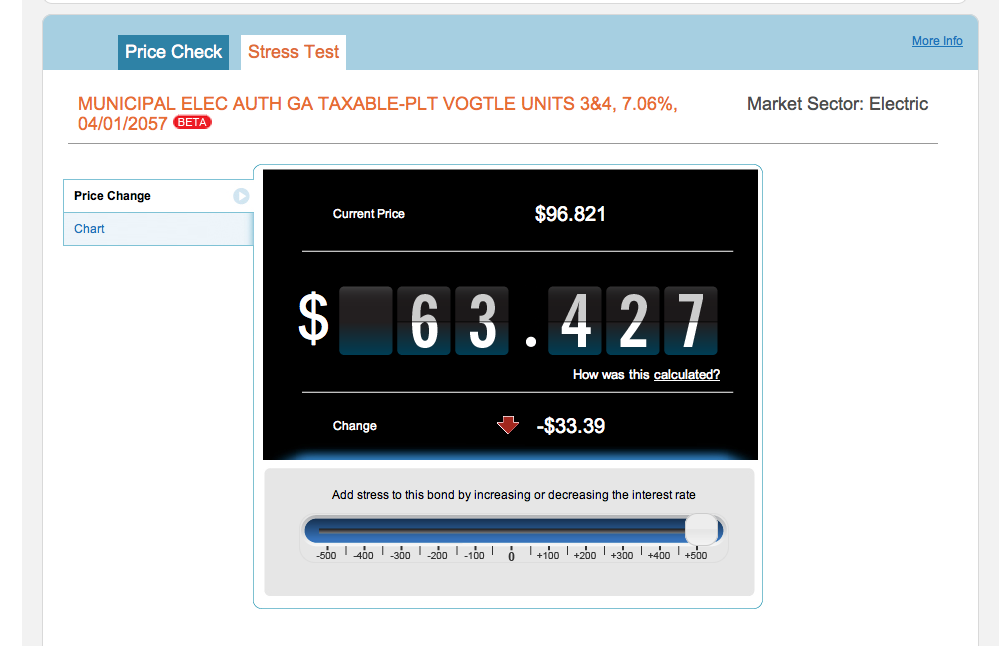

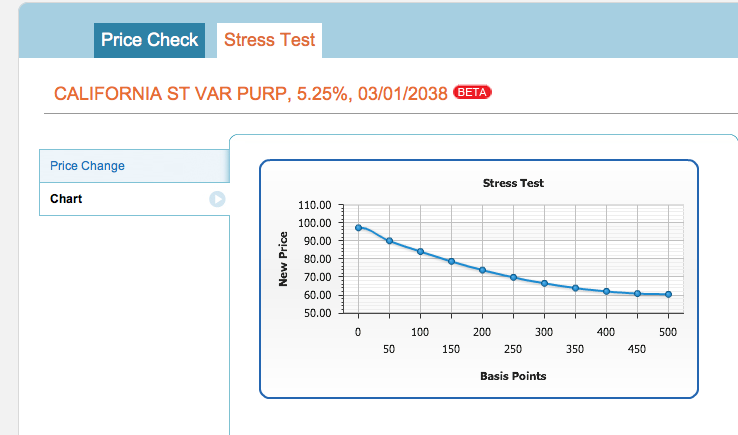

The threat of rising interest rates is not welcome news for municipal bond investors. As the economy comes out of recession, the threat of inflation may result in interest rate increases. This will consequently lead to a lowering of bond prices as bond yields rise. To determine the possible effect of changes in interest rates on municipal bond prices, the BondView Stress Test calculator was created to easily allow a user to vary interest rates, in 50 basis point increments from +/- 550 basis points, and show the resulting price change in a municipal bond, or a whole bond portfolio, given the current price, coupon rate and maturity.

A Stress Test, also known in the bond industry as a “Shock Test“, uses two financial concepts to calculate changes in bond prices as interest rates change: 1) Modified Duration and 2) Convexity. Using duration, it’s possible to approximate how much a bond’s price is likely to rise or fall when interest rates change. As interest rates increase, a bond’s price decreases. Duration measures how quickly a bond will repay its price. The longer it takes, the greater exposure the bond has to changes in the interest rate environment. Therefore, the longer the duration, the higher is the interest rate risk (as opposed to default risk).

Modified duration, uses the duration to calculate the price change of a bond based on the change in yield, maturity and current price. Convexity is a measure of the curvature (non-linear) relationship of a bond’s price change to yield changes. As yields increase, bond prices fall at a decreasing rate. That is, the price fall is not directly proportional to the change in yield as the case using modified duration. The BondView stress test adds a convexity correction to the modified duration to account for this.