How to Buy Municipal Bonds

If you’re considering buying a municipal bond, there are different ways to approach this process depending on your experience and preference. The Municipal Securities Rulemaking Board, or MSRB, has a resource available that guides you through how you can take part in the municipal bond market. Continue reading to learn how to buy municipal bonds.

Use the services of a municipal securities dealer.

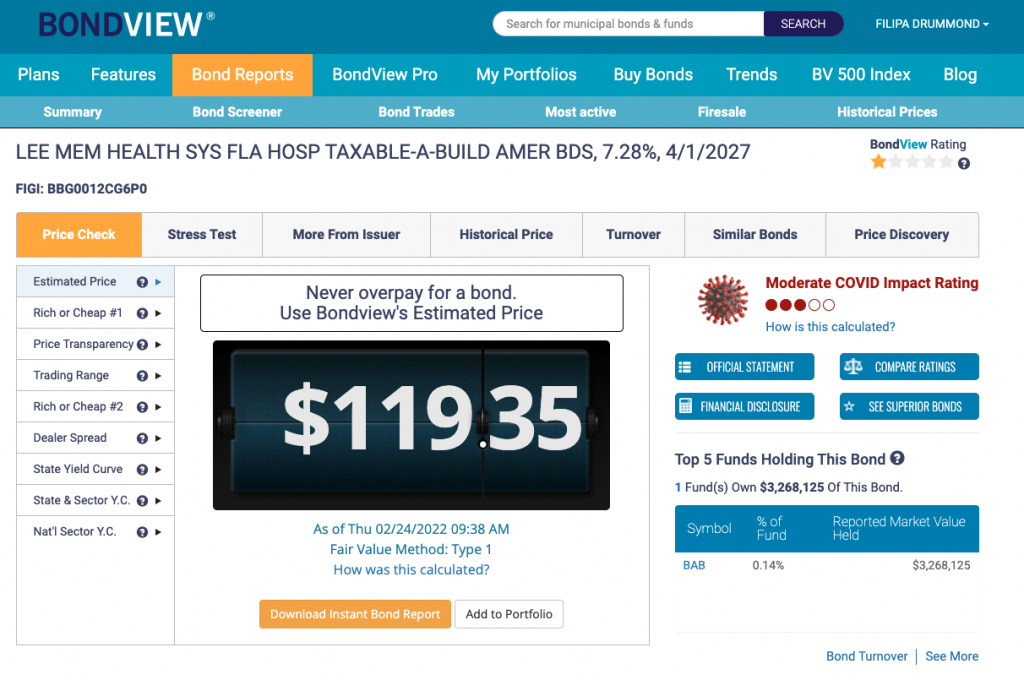

These services can be offered by broker-dealers or by bank departments. A private client broker is a broker who primarily deals with individual investors. Municipal bond purchases and sales are preceded by a discussion with the investor, and the investor must give an explicit order to buy or sell securities in a brokerage account. When selling municipal securities broker-dealers are required to fulfill certain obligations to investors. For example, when an investor buys or sells a municipal security, a broker-dealer must disclose all material information about the municipal security to the investor and must offer a fair and reasonable price. You can use third-party tools, like BondView, to do your own price check before giving your broker the green light to buy municipal bonds.

When full-service broker-dealers buy or sell bonds on behalf of investors, they charge a fee. Broker-dealers charge a mark-up when they sell bonds to investors and a mark-down when they buy bonds from investors when they act “as principal” (that is when they facilitate trades through their own inventory). The fee is known as a commission when broker-dealers act “as agent”. The MSRB brochure contains useful information about mark-ups and mark-downs, as well as other types of fees that brokers may charge.

Hire an investment adviser who can locate and trade bonds on your specific instructions or general authority.

A registered investment adviser (RIA) manages accounts and purchases and sells securities following an investor’s agreed-upon strategy, without requiring individual approval for each transaction. When you hire an RIA, you should receive written documentation that explains both the investment policy that applies to your account and the RIA’s investment process. To obtain a better price, RIAs frequently combine purchases for multiple clients by trading in larger blocks. Account-holders are typically charged a management fee by RIAs. Some advisers charge based on the interest rate environment and the resulting interest earnings.

Purchase or sell municipal bond mutual fund shares.

Another way to buy municipal bonds is to purchase shares in a mutual fund that invests in muni bonds. Mutual funds that invest entirely or partially in municipal bonds can be an effective way to diversify investment holdings. While muni funds can provide built-in diversification in municipal bond investing, you do not directly own those bonds. Instead, you own a stake in the fund. This is significant because changes in interest rates have a different impact on owners of municipal bond mutual funds than on direct owners of municipal bonds.

Many investors who purchase individual municipal bonds intend and do hold them to maturity, even though the market value of bonds fluctuates between purchase and maturity. Mutual fund managers, on the other hand, want to keep the share price stable or rising. If rising interest rates cause the market value of bonds in the mutual fund portfolio to fall, some of those bonds will be sold at a loss to limit further losses and pay for share withdrawals. As a mutual fund shareholder, you are vulnerable to fluctuations in the fund’s value.

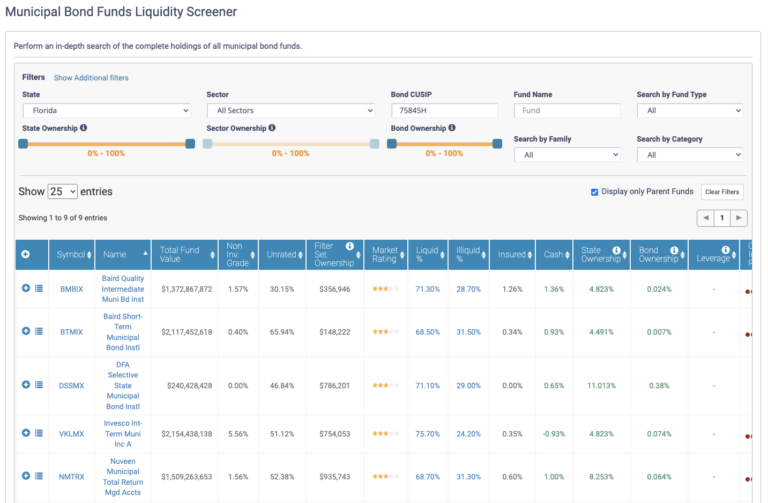

You can use BondView’s Fund Screener to perform an in-depth search of the complete holdings of all municipal bond funds.

Buy or sell in a municipal bond exchange-traded fund (ETF).

ETFs combine features of mutual funds and traditional stocks. The majority of municipal bond ETFs are intended to track an underlying index. Because a municipal bond ETF is traded like a stock, its share price may differ from the ETF’s underlying net asset value (NAV). This can add another level of volatility to the price of a municipal bond ETF that a municipal bond mutual fund does not have. When an investor buys or sells shares of a municipal bond ETF, the transaction takes place over the exchange between investors (buyers and sellers). When an investor buys or sells shares in a municipal bond mutual fund, the transaction is handled directly by the mutual fund company. Municipal bond ETFs trade like stocks during market hours. Municipal bond mutual funds are only available for purchase and sale once per day.

Use a self-managed account to trade directly online.

Another option for investors who prefer to buy and sell muni bonds on their own is to use a self-managed account, also known as “direct online trading,” which is done without the assistance of a private client broker or RIA. This is a broker-dealer account that, like a full-service brokerage account, charges commissions, mark-ups, and markdowns. The firm has the same obligations to investors as any other broker-dealer, but it may carry them out in a different way. For example, disclosure about a specific bond could be done solely electronically, with no interaction with a private client broker. A self-managed account necessitates that the investor understands the benefits and drawbacks of each transaction.

Use a tool like BondView’s Municipal Bonds for Sale Report to keep track of prices and fluctuations.

BondView’s Municipal Bonds for Sale Report includes bonds that can be bought on the open market via a broker, alongside indicators that help you gauge bond quality. BondView constantly combs the site to showcase muni bonds available for sale that should be worthy of further due diligence by you as you make investment decisions. You can also customize Bondview’s criteria to identify your own buying opportunities.

In Conclusion

Regardless of how you participate in the municipal bond market, before investing in a muni bond, you should consider your investment’s needs and request written information from your financial advisor about how fees are charged and which fees apply to your account.