Understanding Municipal Bond Stress Testing

A Guide for Investors and Financial Advisors

Municipal bonds are a popular investment option for individuals seeking tax-exempt returns and steady income. However, like all investments, municipal bonds come with risks, and it is crucial to stress test them to ensure their resilience under different economic scenarios. In this blog post, we will explore the importance of municipal bond stress testing and how it can help investors and financial advisors manage risk and optimize returns. We will also discuss how BondView can help investors and financial advisors stress test their municipal bond investments, bond funds, and bond portfolios.

What is Municipal Bond Stress Testing?

Municipal bond stress testing is a tool used by investors and financial advisors to assess how municipal bonds perform under different stress scenarios, such as a recession, interest rate shocks, or credit downgrades. The primary objective of stress testing is to determine the resilience of a municipal bond investment, identify potential risks, and develop strategies to mitigate those risks. Stress testing is an essential component of risk management for bond investors and helps them prepare for potential losses in their portfolios.

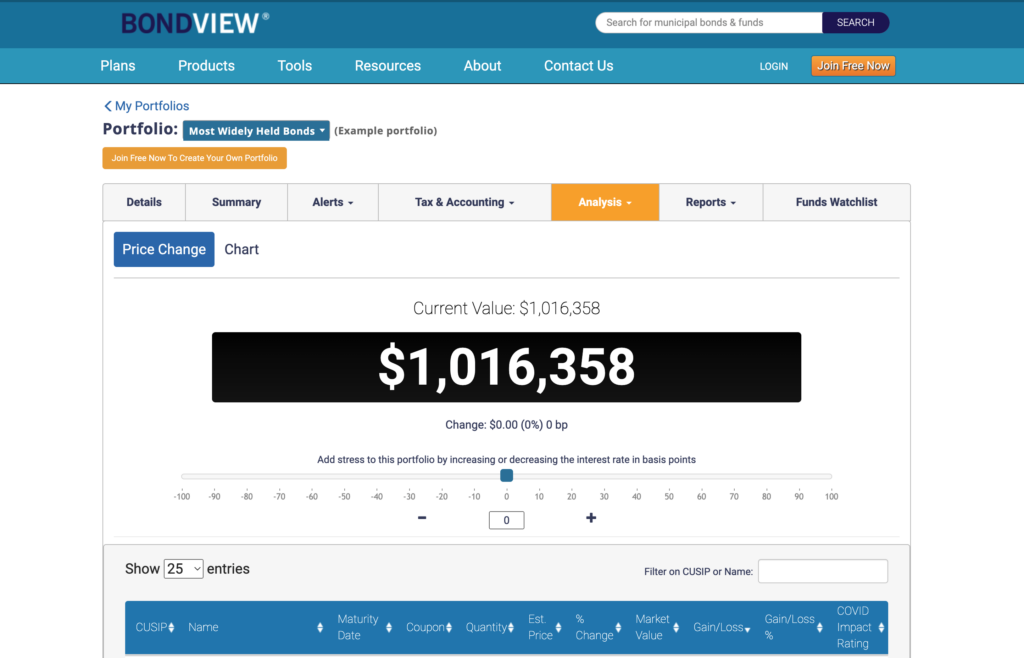

BondView is a powerful tool that helps investors and financial advisors stress test their bond investments, bond funds, and bond portfolios. With BondView, investors can analyze the resilience of their investments under different stress scenarios, including interest rate changes, credit downgrades, or defaults. BondView’s stress testing capabilities provide valuable insights into the potential risks and rewards of municipal bond investing, enabling investors to make informed decisions about their portfolios.

Fund-Level Stress Testing

Fund stress testing involves analyzing the performance of a mutual fund or exchange-traded fund (ETF) under different stress scenarios. For municipal bond funds, stress testing can help investors and financial advisors understand the impact of interest rate changes, credit downgrades, or defaults on the fund’s holdings. It can also help identify funds that may be more or less exposed to certain risks, allowing investors to make informed decisions.

Try BondView’s Municipal Bond Funds Stress Test

Bond Portfolio-Level Stress Testing

Bond portfolio stress testing is a risk management tool that helps investors and financial advisors analyze the resilience of their bond portfolios under various stress scenarios. It allows investors to determine whether their portfolios are properly diversified, identify potential concentration risks, and develop strategies to mitigate those risks. Bond portfolio stress testing is especially important for individuals with large bond portfolios or those who are near retirement and rely on fixed-income investments for income.

Try BondView’s Municipal Bond Portfolio’s Stress Test

The Importance of Bond Stress Testing with BondView

Stress testing is an essential tool for investors and financial advisors seeking to manage risk and optimize returns. By analyzing how municipal bonds perform under different stress scenarios before adding them to their portfolio, investors can identify potential risks and develop strategies to mitigate those risks. With BondView, investors and financial advisors have access to a powerful stress-testing tool that can help them make informed decisions about their municipal bond investments, bond funds, and bond portfolios. Whether you are an experienced investor or new to the world of municipal bonds, BondView can help you understand the whole story behind each bond, issuer, and fund during your decision-making process.