Top 10 Municipal Bonds for Sale

List of Municipal Bonds for Sale

This selection of top municipal bonds for sale is distinguished by their top-tier BondView ratings and credit assessments, which can indicate low default potential and robust fiscal health. Whether you’re searching for the best municipal bonds to buy now or just starting to build a portfolio, this report aims to guide investors in making more informed decisions.

Only 4 municipal bonds for sale met the criteria today.

Subscribe to BondView to view all bonds available for sale.

| CUSIP | Name | Quantity Available | Maturity Date | Yield to Worst | Coupon | Insured | Asking Price | Bondview Estimated Price | Bondview Rating | BV Credit Score | Funds |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 083775FC5 | BERGEN CNTY N J IMPT AUTH LEASE REV CNTY GTD-TWP SADDLE BROOK PROJ | 100 | 08/01/2042 | 3.10% | 5% | No | $109.63 | $108.60 | 5 | 10 | 1 |

| 130179UU6 | CALIFORNIA EDL FACS AUTH REV STANFORD UNIV-SER V-3 | 5 | 06/01/2033 | 2.90% | 5% | No | $115.52 | $119.79 | 5 | 10 | 5 |

| 13032UH68 | CALIFORNIA HEALTH FACS FING AUTH REV STANFORD HEALTH CARE-SER A | 50 | 08/15/2033 | 2.94% | 5% | No | $115.55 | $118.89 | 5 | 8 | 5 |

| 13067WRY0 | CALIFORNIA ST DEPT WTR RES CENT VY PROJ REV SER BB | 55 | 12/01/2031 | 2.80% | 5% | No | $111.82 | $114.88 | 5 | 10 | 2 |

This list was last updated January 16, 2025.

Why Invest in Municipal Bonds

Summary Statistics

Credit Quality:

- All bonds have the highest possible Bondview Rating of 5

- BV Credit Scores are excellent, with three bonds scoring 10/10 and one scoring 8/10

- None of the bonds are insured, but their high ratings suggest strong underlying credit quality

Pricing and Yields:

- Yields range from 2.80% to 3.10%, with Bergen County offering the highest yield

- All bonds are trading at premium prices (above 100)

- There are some price discrepancies between asking prices and Bondview estimated prices, with estimated prices generally higher than asking prices for California bonds

Investment Characteristics:

- Maturities range from 2031 to 2042

- All bonds carry a 5% coupon rate

- Quantities available vary significantly (5 to 100 bonds)

The bonds represent strong credits (Stanford University, California State, Bergen County) which suggests low default risk and strong fiscal health. The California municipal bonds are trading closer to their estimated values, which might indicate more efficient pricing in that market.

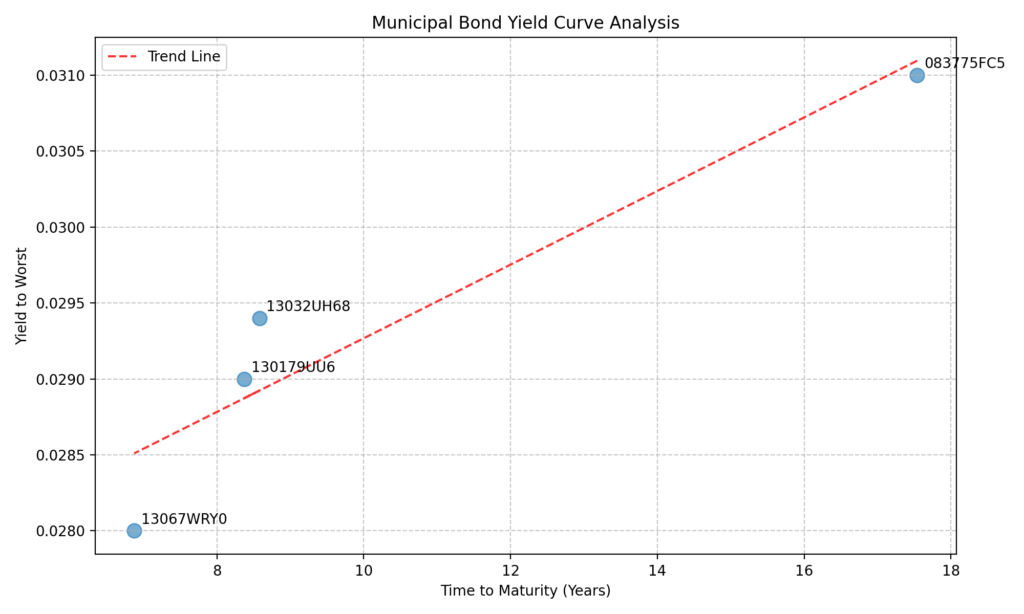

Yield Curve Analysis

When evaluating municipal bond rates, the yield spread is a key factor to consider. Below is a breakdown of some noteworthy muni bonds and their respective yield spreads:

The yield curve analysis reveals several important patterns:

- Yields increase with longer maturities, indicating normal term structure

- Slope suggests approximately 3 basis points of yield pickup per year of maturity

Maturity Distribution:

- Short end: California Water Resources (13067WRY0) at 6.87 years with 2.80% yield

- Mid-range: Two California bonds (130179UU6, 13032UH68) clustered around 8.5 years with yields of 2.90-2.94%

- Long end: Bergen County (083775FC5) at 17.54 years with 3.10% yield

Relative Value Points:

- Bergen County offers the highest absolute yield at 3.10%

- California Health Facilities (13032UH68) shows slight yield premium versus similar-maturity California Education bond

- California Water Resources shows lowest yield but shortest duration

The upward-sloping curve suggests the market is pricing in term premium appropriately, with longer-dated bonds offering higher yields to compensate for increased interest rate risk.

Best Value Municipal Bonds (Highest Yield Spread to Credit Score Ratio):

Below are the best value municipal bonds based on the yield spread to credit score ratio—a metric that helps identify bonds offering strong returns relative to risk:

The California Health Facilities bond (CUSIP: 13032UH68) offers the best value with the highest ratio, followed by Bergen County (CUSIP: 083775FC5). This suggests these muni bonds for sale provide the most yield relative to their credit quality.

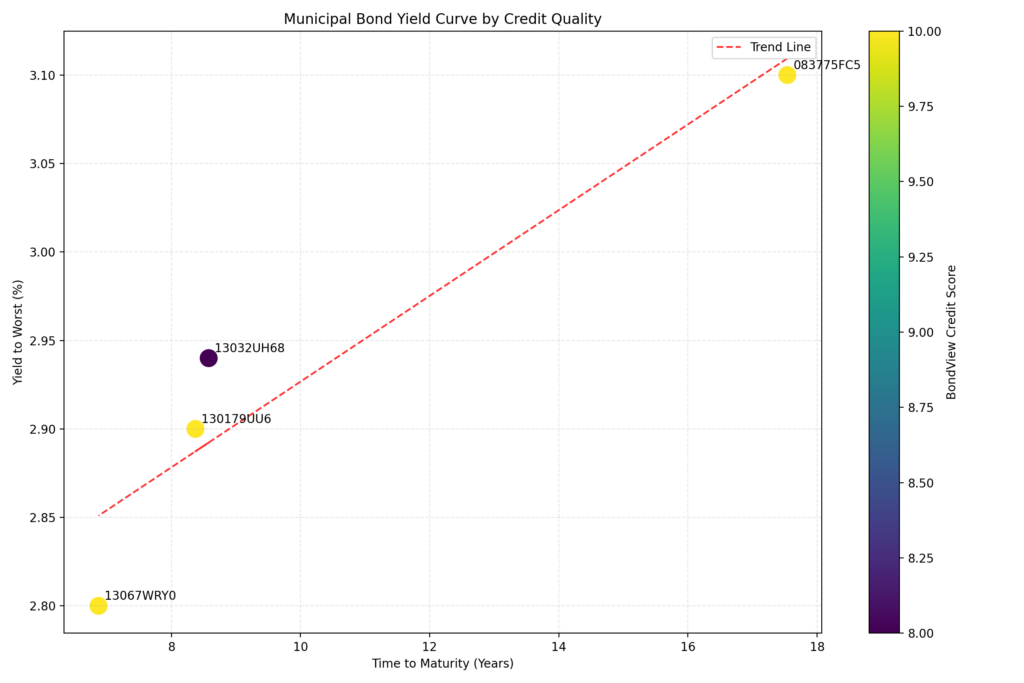

Yield Curve and Credit Quality

Understanding the relationship between yield curves and credit quality is crucial for investors. Typically, longer-term bonds offer higher yields due to the extended risk, while shorter-term bonds are favored for their lower risk.

Investors can use this information to assess municipal bonds for sale based on their risk-return profile. This approach allows you to align your bond selection with your financial goals, whether you seek top-rated municipal bonds for safety or bonds offering higher yields with some added risk.

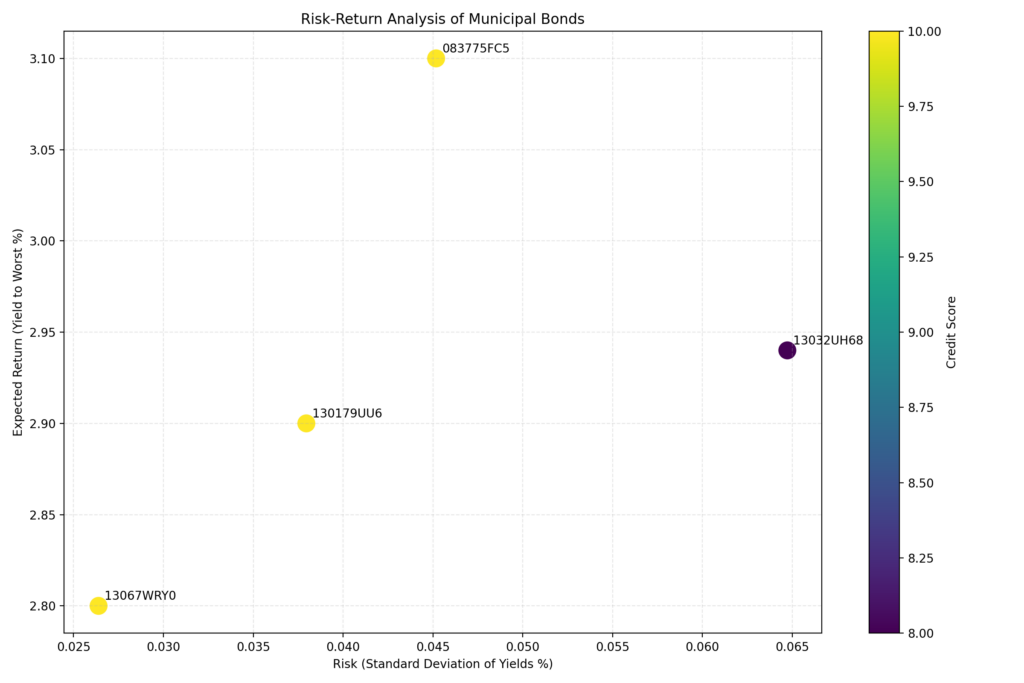

Risk-Return Analysis for Top Municipal Bonds

This analysis compares yield to worst with BV credit scores to reveal the best municipal bonds based on their risk-return profile. Bonds with high yields and high credit scores represent the most attractive investments.

Potential Risks

Risk Profile (Standard Deviation of Yields):

- Lowest Risk: 13067WRY0 (California Water Resources) at 0.026%

- Highest Risk: 13032UH68 (California Health Facilities) at 0.065%

- Moderate Risk: 083775FC5 (Bergen County) at 0.045%

- Moderate-Low Risk: 130179UU6 (California Education) at 0.038%

Risk-Adjusted Returns (Higher is better):

- Best: Bergen County (083775FC5) – 13.28

- Second: California Water Resources (13067WRY0) – 11.37

- Third: California Education (130179UU6) – 10.54

- Fourth: California Health Facilities (13032UH68) – 6.80

Key Insights:

- Bergen County bond (083775FC5) offers the best risk-adjusted return despite moderate risk due to its higher yield

- Price stability analysis shows that the Bergen County bond (CUSIP: 083775FC5) is trading closest to its estimated value, while others have a higher price discount, indicating potential market mispricing.

- California Water Resources bond (13067WRY0) shows strong risk-adjusted performance due to very low risk

- California Health Facilities bond (13032UH68) has the lowest risk-adjusted return due to higher risk and lower credit score

- The California Health Facilities bond (CUSIP: 13032UH68) has the highest liquidity score, making it the easiest to trade.

- All bonds with credit score of 10 show better risk-adjusted returns than the lower-rated bond

Investment Implications:

- Bergen County bond offers the best value proposition considering risk and return

- California Water Resources bond is suitable for risk-averse investors

- California Health Facilities bond may require additional yield premium to compensate for its risk profile

- Credit quality shows strong correlation with risk-adjusted performance

Top Muni Bonds: Issuer Information

- Bergen County Improvement Authority, New Jersey

- California Educational Facilities Authority

- California Health Facilities Financing Authority

- California State Department of Water Resources

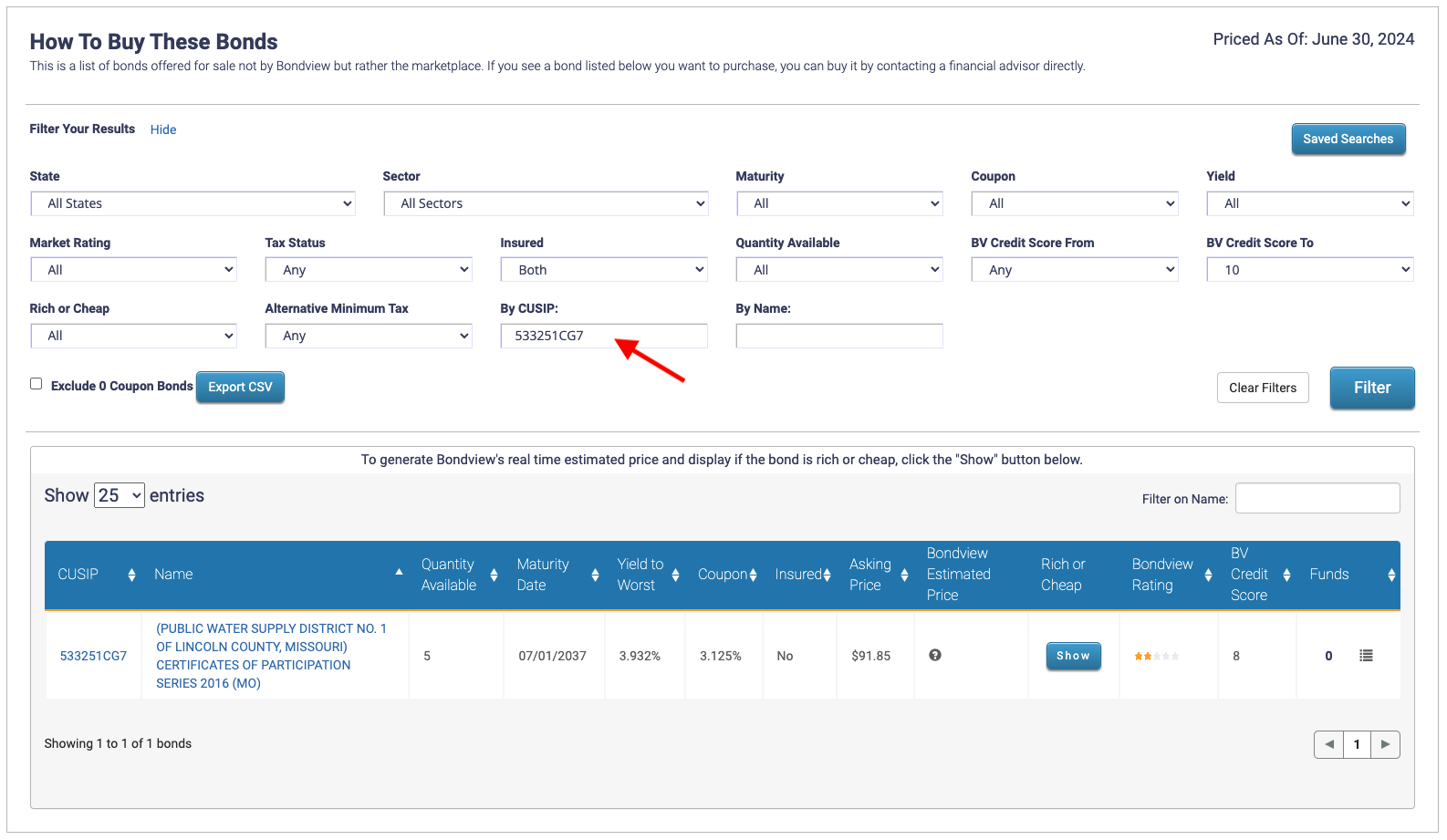

How to Find Municipal Bonds for Sale on BondView

The bonds on this article were found using BondView’s Buy Bonds feature. This feature was built to help investors discover new investment opportunities.

To get started, log into your BondView account. If you don’t have an account yet you can request a free trial here.

Step 1: Go to “Buy Bonds

Step 2: Choose the filter details that fit your criteria. For this list we selected:

- Yield: 2%-4%

- Market Rating: 5 stars

- BV Credit Score: 8-10

If you have more variables you need to take into account, you can also filter by state, sector, maturity date, coupon, tax status, insured, quantity available, rich or cheap, alternative minimum tax.

Step 3: Go through your list of municipal bonds for sale. Start by sorting your list of municipal bonds from highest to lowest yield. Then, click “Show” under the “Rich or Cheap” column to view BondView’s estimated price and assess whether a bond is valued at a fair price.

Step 4: Find out which funds hold each municipal bond and who insures it.

- Fund Details: Click on the icon right next to the number of funds, under the “Funds” column. It will show you a list of funds that own the bond you are looking at.

- If a bond is insured, hover over the “i” icon next to “Yes” under the “Insured” column to find out who insures the bond.

Bonus: If you want to find out whether a specific bond is available for sale, you can search directly by CUSIP or Name.

For Investors & Analysts

Keep Your Broker Honest

Your broker may not reach out to you proactively about bonds for sale and may not know all your options. With BondView, you can rest assured that you have the same or better information than your broker.

Verify A Muni Bond Quote

Get an accurate price for a bond that your broker has pitched. Verify your own estimated price against its real-time asking price.

Gauge Ease Of Buying Or Selling A Bond

BondView provides 3 liquidity indicators in this report. See how in demand a bond is based on the funds that hold this bond and their buy/sell activity. Do the same for public and BondView portfolios.

This list is updated every 2 months.

This list of municipal bonds for sale is current as of Jan. 15, 2025. For real-time information, use BondView as your guide. A quick CUSIP entry or advanced search reveals details such as interest rates, coupon rates, maturity dates, recent trade prices, and credit ratings.

Note: As with any investment, the market value may vary during the period the investment is held. This article is informational only and does not a substitute for professional financial advice. Please check with your financial advisor before making any investments. Subject to prior sale and market conditions as of 15/01/25.