End-of-year muni strategy

Municipal bond investors are increasingly taking advantage of a tax swap strategy to ease the tax burden of cashing out profitable assets while acquiring high-quality, long-term municipal bonds.

This strategy is a form of tax-loss harvesting that helps soften the financial blow of unloading profitable investments. The idea behind tax swaps is to enable investors to:

- Take the loss for tax purposes and offset capital gains, dollar for dollar, without losing their position in the municipal bond market or missing a day of interest

- Use the change in market values wisely, as market fluctuations are immaterial for municipal bonds

This year, more investors are participating in tax swaps, and market conditions have prompted them to start doing it earlier in the year.

The IRS allows investors to offset up to $3,000 per year of adjusted gross income and carry forward any remaining losses, dollar for dollar, into ensuing years.

However, these trades become more difficult to execute as the December 31 deadline approaches.

Understanding the 30-Day Wash Sale Rule and Munis

The 30-day wash sale rule is a tax regulation that prevents investors from claiming a loss on the sale or other disposition of a security if they acquire the same or a “substantially identical” security within 30 days before or after the sale. This rule is in place to prevent investors from using capital losses to their advantage at tax time.

Key aspects of the wash sale rule include:

- 30-day window: The rule applies to transactions within 30 days before or after the sale of a security at a loss.

- Substantially identical: The rule considers a security to be substantially identical if it is similar enough to the original security that it could be considered a replacement for tax purposes.

- Applicability: The wash sale rule applies to both short and long-term capital gains, as well as losses.

To avoid violating the wash sale rule, investors should be cautious when selling securities at a loss and repurchasing similar securities within the 30-day window.

However, there are some exceptions and strategies to minimize the impact of the wash sale rule, such as selling the security and immediately buying shares of a different company in the same industry or shares in a mutual fund that holds securities much like the ones you sold.

Investors need to work closely with their tax advisors to ensure they are compliant with the wash sale rule and other tax regulations.

Understanding Tax Loss Harvesting with Munis

This strategy used to minimize annual tax liability by selling underperforming investments at a loss and using the loss to offset or even eliminate realized gains on other investments.

This technique is commonly associated with equities but can also be applied to municipal bonds. The main benefits of tax loss harvesting with munis include:

- Offsetting realized gains: Selling losing investments can help offset realized gains elsewhere in your portfolio for the current tax year.

- Reducing taxable income: If you have leftover losses, you can reduce your taxable income by up to $3,000

- Carrying the loss forward: If you cannot offset all your losses in the current year, you can carry the loss forward into another tax year and use it in the future.

When applying tax-loss harvesting to municipal bonds, it is essential to consider the value of your securities relative to your cost basis, not your original investment, and focus on bonds with a shorter duration.

It can be particularly attractive during periods of heightened market volatility, as it allows investors to increase after-tax returns in their muni portfolios.

Start evaluating whether these strategies are right for you:

Start evaluating whether these strategies are right for you

1. Comprehensive Portfolio Review

- Begin with a thorough review of your entire muni bond portfolio.

- Identify bonds that have declined in value since purchase. These are potential candidates for tax loss harvesting.

- Assess the credit quality and duration of these bonds. It’s crucial to understand if the loss is due to market fluctuations or a fundamental decline in creditworthiness.

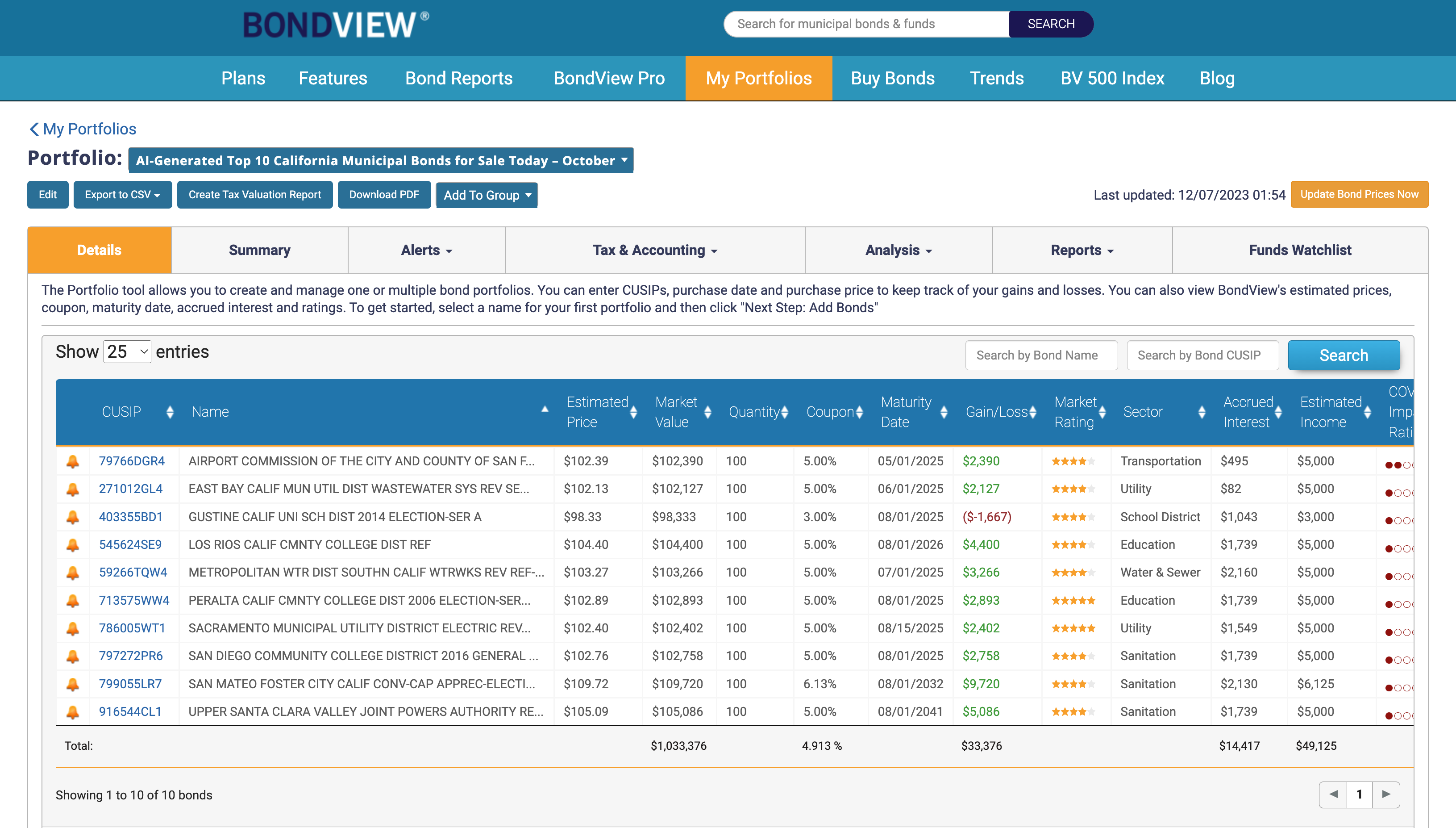

For example, BondView’s portfolio tool allows you to keep track and verify all of this information easily. Setup your portfolio, with the dates of purchase to get a quick overview.

Then dig deeper into the Tax & Accounting and Analysis features to get to the details you need to make the most informed decision.

2. Market Analysis and Forecasting

- Analyze current market trends, interest rate forecasts, and economic indicators.

- Understand how these factors might impact different types of munis, such as general obligation bonds versus revenue bonds.

- Consider how upcoming economic policies or changes could affect the muni market.

3. Identifying Potential Bonds to Purchase

- Before selling any bond, identify potential munis to buy.

- Look for bonds that fit your portfolio’s needs but are not “substantially identical” to avoid falling inadvertently under the wash sale rule.

- Consider diversifying across different states, municipalities, or project types to enhance portfolio resilience.

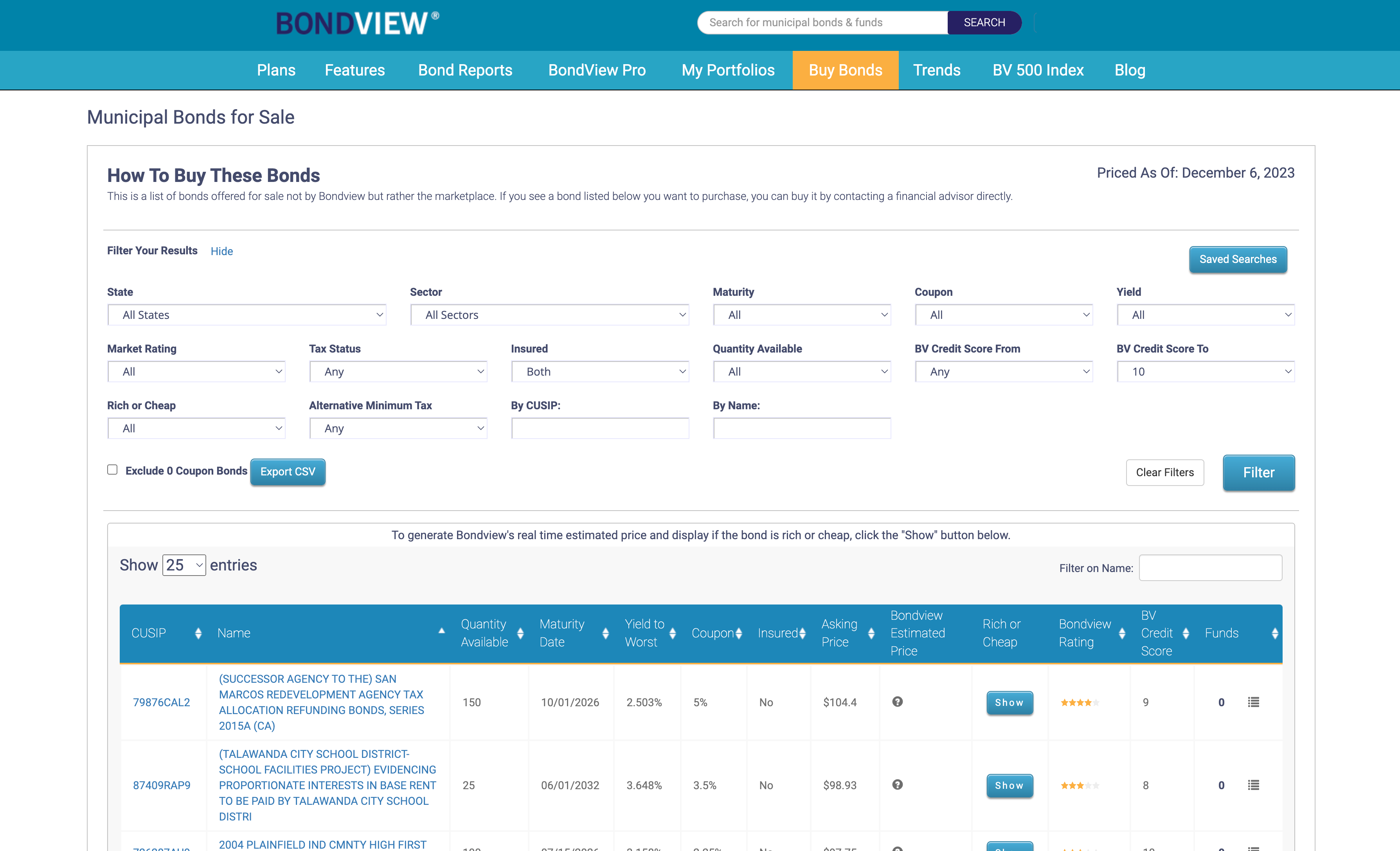

A tool like BondView’s Buy Bonds allows you to find the bonds you are looking for. Filter out the variables you want to avoid, clear out the noise and start looking for hidden gems.

4. Tax Considerations

- Document all transactions meticulously for tax purposes.

- Calculate the capital loss and understand how it can offset any capital gains and up to $3,000 of ordinary income.

- Consult with a tax professional to optimize the tax benefits and ensure compliance with IRS rules.

6. Monitoring and Adjusting

- Continuously monitor the performance of the new munis in your portfolio.

- Be prepared to make further adjustments as market conditions evolve.

- Regularly review your portfolio to align with your investment objectives and risk profile.

7. Long-Term Strategic Planning

- Use this end-of-year strategy as part of a broader, long-term investment strategy.

- Consider how these moves fit into your overall financial goals, such as retirement planning, income generation, or wealth preservation.

- Regularly consult with your financial advisor to ensure your muni bond investments complement your broader financial plan.

Conclusion

Implementing end-of-year muni bond strategies, particularly those focusing on the wash sale rule exemption and tax loss harvesting, involves careful planning and execution. It’s not only about the short-term tax advantages or market positioning; it’s also about how these changes fit into your long-term investing strategy.

Please consult a financial advisor before making any decisions to validate whether this is the right strategy for you.