How to Monitor Your Bonds Effectively

Municipal bonds have long been considered a reliable and steady source of income for investors. However, as with any investment, monitoring your municipal bond portfolio closely will influence your long-term results. In this article, we’ll delve into the importance of municipal bond monitoring and which metrics to keep an eye on.

Why Monitoring Your Municipal Bonds Important?

When it comes to managing a municipal bond portfolio, being proactive rather than reactive can make all the difference. Regular monitoring serves as a critical tool for investors aiming to protect their financial interests, stay updated on market trends, and optimize their investment strategy.

- Protecting Your Investment: Your municipal bond portfolio represents a significant financial commitment. Regular monitoring ensures that you understand how your municipal bonds are performing at any given time to safeguard your investment against potential risks.

- Staying Informed The financial landscape is dynamic, and changes can occur rapidly. Monitoring allows you to stay informed about market developments, issuer conditions, and other factors that could affect your bonds.

- Optimizing Your Portfolio Monitoring enables you to detect anomalies and make informed decisions about buying, selling, or holding bonds – at the right time. It helps you optimize your portfolio to pivot when needed and achieve your financial goals.

Risk factors can take different forms, so detecting anomalies will allow you to stay ahead of the game:

- Interest Rate Impact: The value of your bond in the secondary market can be influenced by shifts in prevailing interest rates.

- Credit Rating Changes: Alterations in your bond’s credit rating can have an impact on its overall valuation.

- Liquidity Fluctuations: Various factors can affect the ease of selling your bond or assessing its value, so it’s important to monitor liquidity.

- Issuer’s Financial Health: Changes in the financial situation of the bond issuer can affect their ability to make timely payments of interest and principal.

Key Metrics to Keep an Eye On

Keeping an eye on key metrics is not just recommended—it’s essential. With tools like BondView, you can go beyond mere ownership to active management of your portfolio.

- Credit Ratings: Credit ratings offer valuable insights into the likelihood of timely repayment. BondView provides credit rating information, which can change over time and should be regularly monitored.

- Liquidity: Bond liquidity is essential, especially if you ever need to sell a bond before maturity. BondView’s tools can help you assess the liquidity of your bonds and make informed decisions.

- Issuer’s Financial Condition: The financial health of the issuer is paramount. BondView provides access to official statements and disclosures, allowing you to track changes in an issuer’s financial condition over time.

How to Monitor Your Bonds

Step 1: Effective Portfolio Management

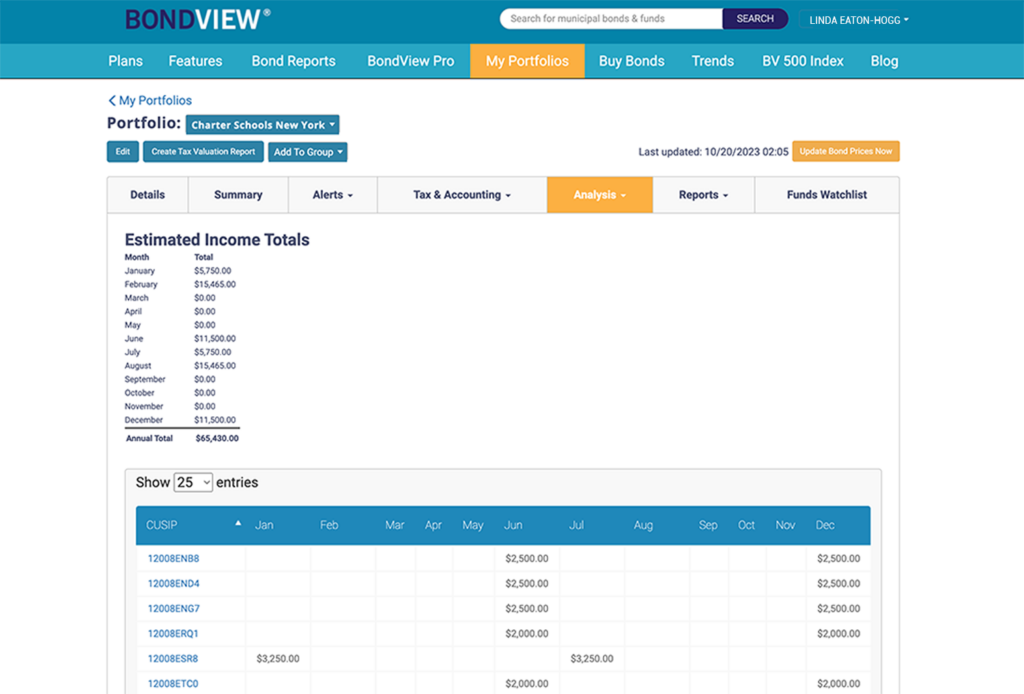

Setup your portfolio with as many details as you need to effectively manage your investments. BondView offers a tool that empowers you to create and manage one or multiple bond portfolios. Easily track gains, losses, accrued interest, and other essential metrics.

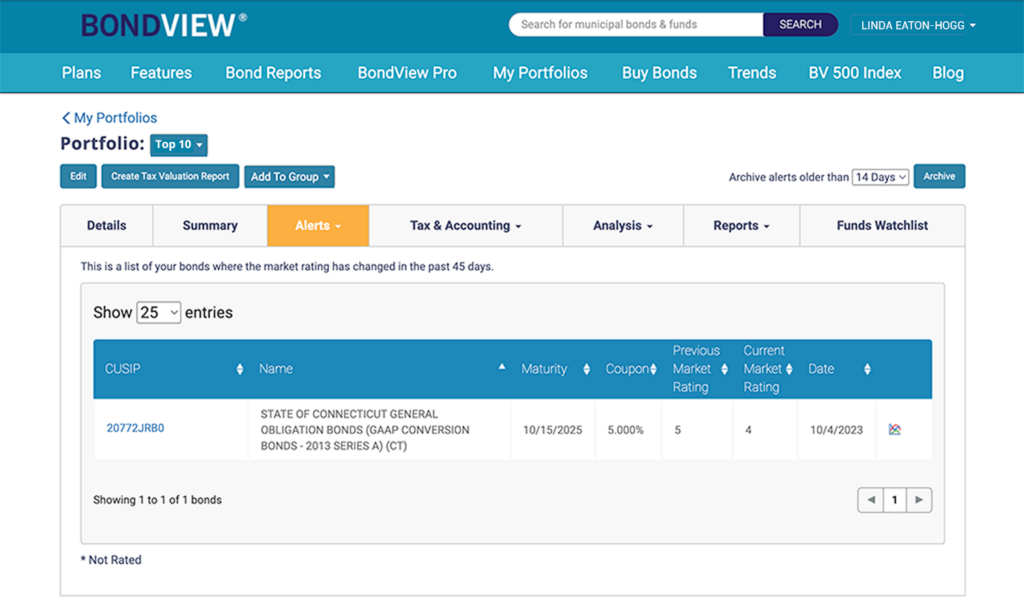

Step 2: Alerts

Setup a 24/7 Early Warning Alert System that notifies you of important updates related to your bonds so you are always aware of the most recent changes. For example, with BondView’s Bond Surveillance you’ll be alerted of any changes worth looking into before you know to look for them.

If you already have a BondView account but haven’t properly set up your portfolio’s alerts, go to My Profile > Alert Settings.

Here are some examples of alerts designed to help you monitor your investments effectively:

- Change Market Rating

- Liquidity Rating Change

- Yield Rating Change

- Rapid Price Change Decrease

- Rapid Price Change Increase

- Defaulted

- Big Movers

- Volume Trending Higher

- Maturing Bonds

- Discount Bond Price Increase

- Premium Bond Price Decrease

- Trending Higher

- Trending Lower

Step 3: Price Discovery

For bonds that don’t trade frequently, BondView’s price discovery tool will help you determine their value by comparing them to similar bonds with more active trading.

If you manage diverse bond portfolios, a price discovery tool will help you determine fair market value and track the current values of individual bonds within the portfolio. This will allow investors to rebalance and optimize your portfolio.

Final Thoughts

Bond monitoring is a fundamental aspect of managing your municipal bond investments. Regularly tracking key metrics such as the issuer’s financial condition, credit ratings, and liquidity can help you make informed decisions to protect and optimize your portfolio.

Please feel free to reach out to us via email or visit join.bondview.com to explore the wide range of comprehensive tools and resources available to bond investors.

Remember, in the world of investments, knowledge is power, and BondView empowers you with the knowledge you need to make sound financial decisions.