The Mouse That Roared: Disney

Disney Related Bonds Trade 10% Lower On Fitch Agency Downgrades and BondView Lowers Market Rating to 2 Stars.

Fitch Ratings put the Reedy Creek Improvement District’s (RCID) bonds on “negative watch,” indicating that a downgrade is probable in the future. The action comes only one day after the Florida Legislature enacted a law dissolving the Walt Disney Company’s Central Florida enclave. The news caused various Reedy Creek bonds to trade more than 10% lower, and accordingly, Bondview has lowered its Market Rating to 2 Stars.

The Market Rating is computed based on the bond’s return relative to the yield of a treasury bond of equivalent maturity. Bonds are rated from 5 stars (Best) to 1 (Worst). A 2-star market rating, for Disney Bonds, stands for “Increasing economic volatility can lead to even wider swings in price and yield”; click here to learn more about BondView’s Market Rating.

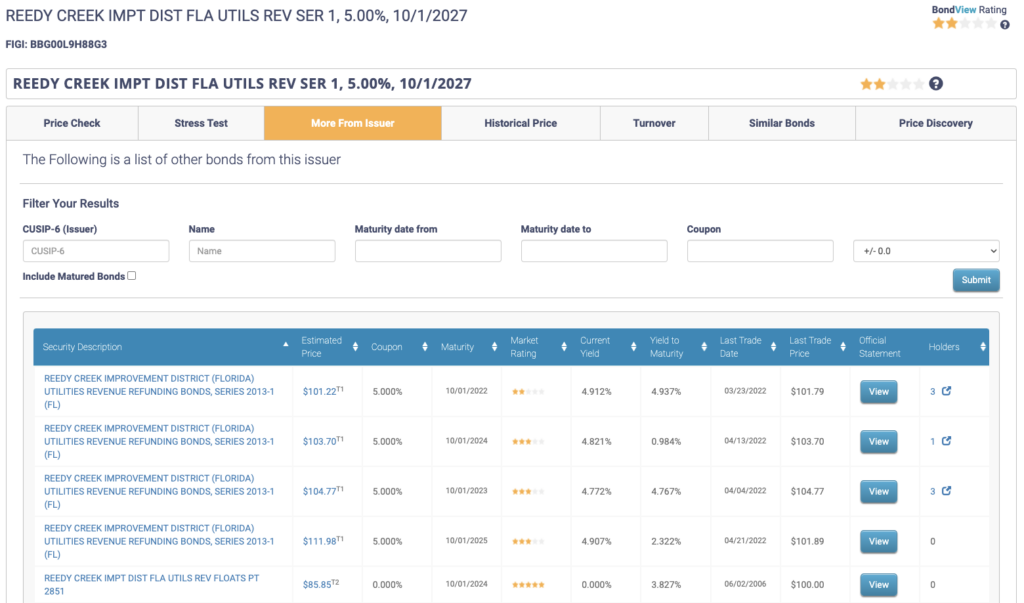

There are $79 million in utility revenue and refunding bonds and $766 million in property tax-backed debts impacted, and BondView tracks and analyzes the status of these bonds daily.

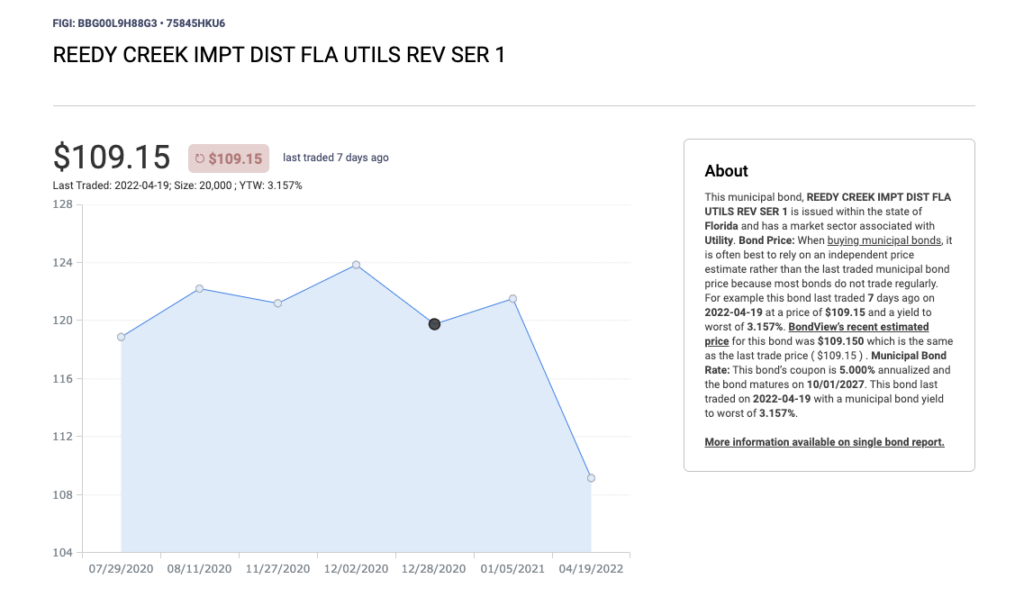

Here is an example of a Reedy Creek bond maturing in 2027, already trading at 11 points lower than before the downgrade. BondView lowered its Market Rating to 2 Stars on various Reedy Creek bonds. The bond traded on 4/19/2022 at $108.52, down from $121.41 about a year ago. A more recent indicator is the bond’s recent Yield-to-Worst of 3.278% compared to the market yield of 2.47% on generic five-year investment-grade bonds. Another way of saying this is that the market requires a higher yield to compensate for the higher default risk.

Most of the bonds issued are not back-stopped by any municipal bond insurance, which would have provided protection to bondholders in the event of a default. That said, a default would seem unlikely, but the future credit and political risks seem unclear at this time.

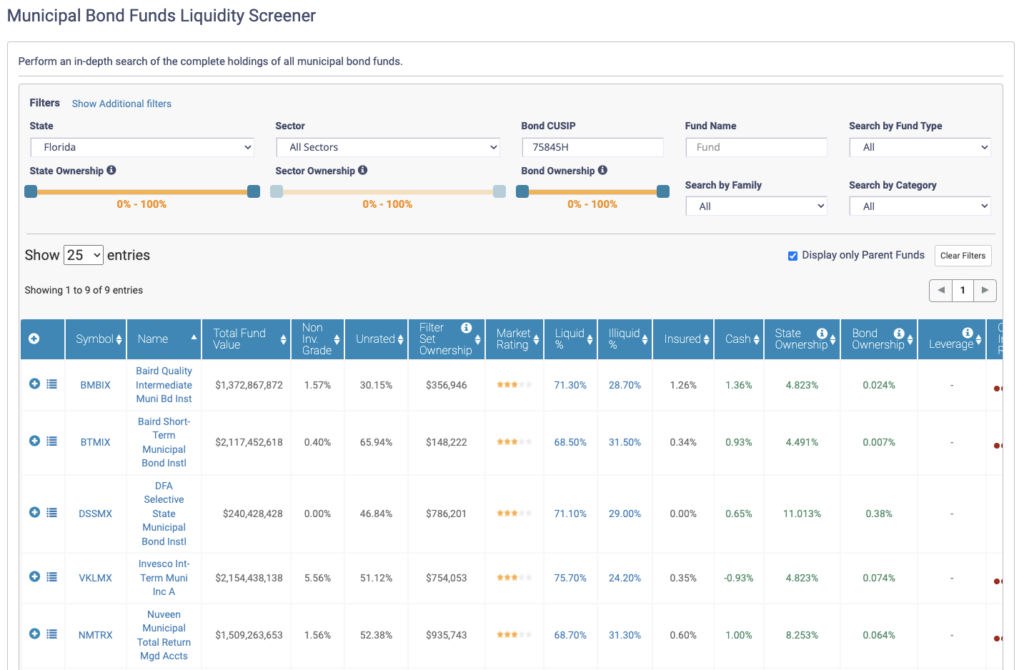

These Municipal Bond Funds own about $8 million in this bond issue, although overall, that amount is much larger as it relates to the 766 million in property tax-backed bonds.

For more information, feel free to contact us at support@bondview.com. Not a part of BondView yet? Sign up for free now.