Continuing Disclosures: What are they?

The municipal bond market is one of the largest globally, with roughly $3.9 trillion in bonds and approximately $11 billion in par traded per day.

Many investors use municipal bonds to improve their after-tax returns and generate investment income due to their unique tax advantages.

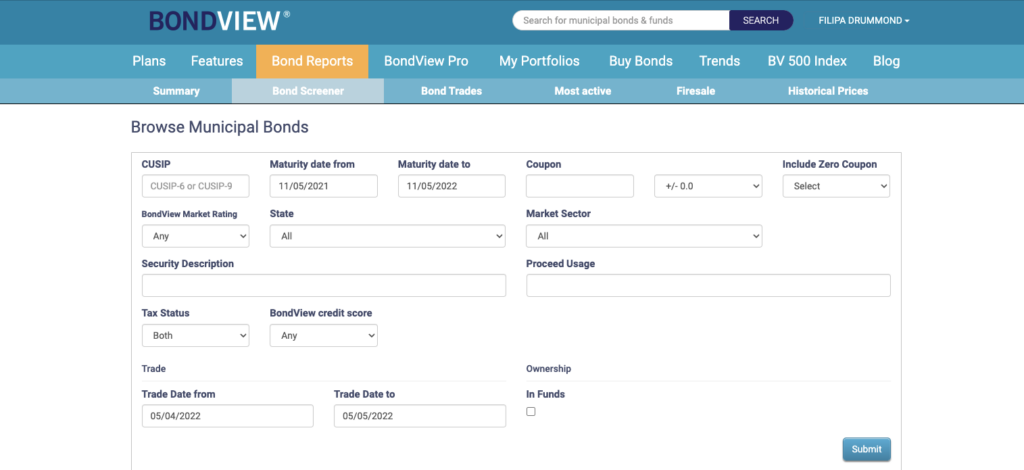

Use BondView’s screener to find the best municipal bonds for your portfolio.

Continuing disclosures are one of the most efficient tools to enhance diligence while searching for the right municipal bonds for your portfolio.

Continuing Disclosures

State or local governments prepare continuing disclosures to communicate important information about municipal bonds that arise after they have been issued.

These disclosures include a number of documents defined in Securities and Exchange Commission Rules 15c2-12 and 15Ga-1, as well as certain voluntary disclosures:

- SEC Rule 15c2-12: Issuers must submit these disclosures per contractual agreements established when a bond is issued.

- SEC Rule 15Ga-1: Issuers must submit these disclosures per contractual agreements established when a bond is issued.

- Voluntary Disclosures: Many issuers make voluntary disclosures that are classified according to their information.

Continuing disclosures can be accessed by investors through the MSRB’s Electronic Municipal Market Access. If you own a specific bond, you can even set up email alerts to stay on top of any new disclosures.

Continuing disclosures are classified into two types:

Financial or operational filings: Regular disclosures made by issuers to keep bondholders up to date. Filings include:

- Audited financial statements,

- annual financial information, and

- any notices of failure to provide annual financial agreements on time.

Event filings: Alert bondholders to specific events that may affect bond repayment. Key events as defined by MSRB include:

- Delinquencies in principal and interest payments

- Unscheduled deductions from debt service reserves

- Defaults that are not payment-related

- Unscheduled credit enhancement draws

- Replacement of credit or liquidity providers

- Tender offers and bond calls

- Defeasances

- Bondholders’ rights have been modified.

- Changes to assets that secure repayment

- Ratings fluctuation

- Asset merger, acquisition, or sale

- Insolvency, bankruptcy, or receivership

- Nomination of a successor trustee

- Tax opinions that are unfavorable or changes in tax status

How Disclosures Can Help Investors:

For investors conducting due diligence on a municipal bond, ongoing disclosures are invaluable. Without them, investors would be forced to rely on potentially out-of-date information, making it difficult to determine whether the bond is suitable.

Financial and operating continuing disclosures are helpful for keeping up-to-date with a municipality’s finances. For example, a bondholder may look at audited financial statements to determine if there are any changes to the state or local government’s ability to repay the bond.

Event-related continuing disclosures are critical for bondholders to reassess their holdings. For example, a bondholder may receive a notice of a change in credit rating, which could lead them to sell the bond. These disclosures are even more important when it comes to distressed bonds.

In conclusion

For municipal bond investors, continuing disclosures are an important due diligence tool. Using EMMA, you can stay up to date on these disclosures and learn about any changes in financial condition, credit ratings, or other factors that may affect the valuation or features of a bond.