How to Find Top High Yield Municipal Bond Funds

Municipal bonds offer tax-advantaged income, making them a popular choice for income-seeking investors, particularly those in higher tax brackets. Among these, high yield municipal bond funds are attracting attention for their potential to offer greater returns, albeit with additional risk. Let’s dive into what they are and whether they might be right for your portfolio.

What are high yield municipal bond funds?

Municipal bonds are essentially loans that state and local governments take from investors to fund public projects, such as infrastructure development, schools, or hospitals. These bonds promise to pay investors regular interest and return the principal once the loan matures, with the income often being exempt from federal taxes and, in some cases, state and local taxes.

High-yield municipal bond funds, typically offered as mutual funds or ETFs, focus on bonds from issuers with a higher risk of default. These bonds often fund projects with uncertain or volatile revenue sources. Because of this increased risk, they offer a higher interest rate (or yield) to attract investors.

While the potential for higher returns is appealing, the nature of these projects can lead to a greater likelihood of repayment issues, so investors must approach them cautiously. Projects like toll roads, new stadiums, or speculative infrastructure improvements can sometimes fail to generate the expected revenue, increasing the risk of default.

Are high yield municipal bonds a good investment?

High-yield municipal bonds have been one of the best-performing fixed-income asset classes recently. Many investors are asking, “Should I consider them for my portfolio?”

Here are the key factors:

- Risk-Reward Balance: High-yield munis carry additional risks compared to investment-grade munis. These risks stem from the underlying projects’ financial stability and the issuer’s creditworthiness. However, the potential for higher returns can appeal to investors in higher tax brackets looking for tax-free income.

- Current Market Conditions: With resilient economic performance, many investors find high-yield munis particularly attractive. If interest rates stay relatively stable and the economy continues its steady growth, the return potential for these bonds remains strong.

- Tax Considerations: The primary advantage of municipal bonds, including high-yield ones, is their tax-exempt status on the federal level, which can be especially advantageous for high-income investors. However, it’s important to note that while high yield munis offer higher yields, their tax-equivalent yields may not always be higher than taxable high yield bonds, depending on an investor’s tax bracket. Investors should calculate and compare tax-equivalent yields to ensure they’re maximizing their after-tax returns.

However, these bonds are not a substitute for investment-grade municipal bonds. While they offer higher yields, the risks tied to potential defaults and project failures are significantly higher. High-yield munis are best for investors who understand the risks and can manage the volatility.

How to find High Yield Municipal Bond Funds

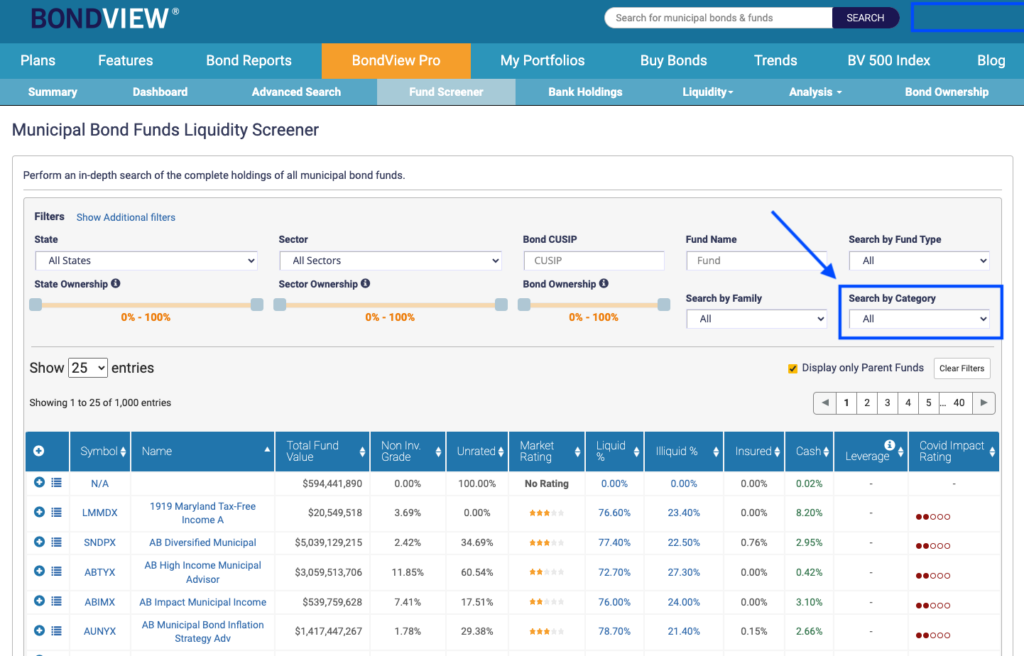

- Go to Municipal Bond Funds Liquidity Screener

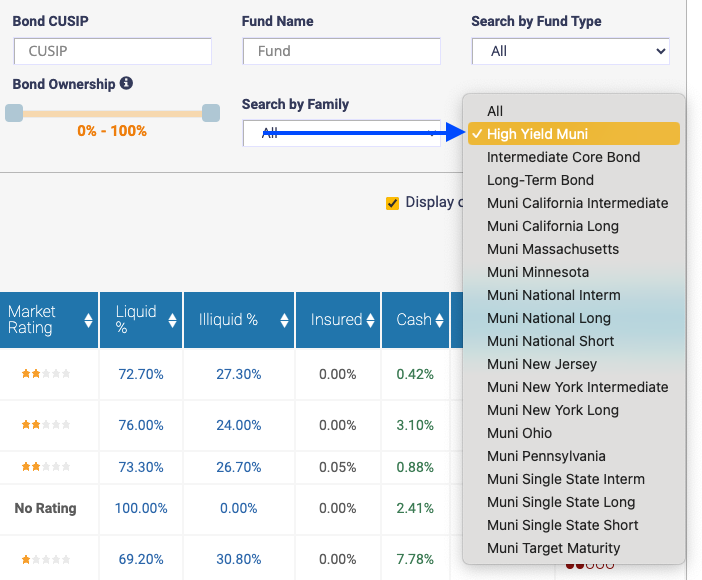

- Find the filter, above the data table and go to “Search by Category”

- Find the High Yield Munis option, and click to select

You will see the data on the table “Processing” and quickly the data on the table will be updated with a list of high yield municipal bond funds.

What to take into consideration when thinking about investing in high yield municipal bonds

Before investing in high-yield municipal bond funds, here are several factors you should keep in mind:

- Credit Risk: The primary concern with high-yield munis is credit risk, or the chance that the bond issuer will default. Investors should research the creditworthiness of the bond issuers in a fund, especially since some may have less stable financial footing.

- Interest Rate Sensitivity: Like other bonds, high-yield municipal bonds are sensitive to interest rate changes. If rates rise, bond prices tend to fall, which can lead to lower total returns. Be mindful of the broader interest rate environment when considering these investments.

- Liquidity Risk: Municipal bond markets can sometimes be less liquid than other fixed-income markets, especially for high-yield issues. This can make it harder to sell bonds quickly or at a favorable price if you need to access your money.

- Economic Conditions: The overall health of the economy plays a critical role in the success of municipal bond projects. In times of economic hardship, revenue generation from these projects may falter, increasing the chance of default.

- Diversification: High-yield munis should be part of a diversified portfolio. Investors may want to pair them with lower-risk, investment-grade municipal bonds or other asset classes to balance the risk-reward ratio.

- Professional Management: High-yield municipal bond funds are often managed by experienced professionals who actively research and select bonds. Look for funds with managers who have a track record of navigating the high-yield market effectively.

By keeping these factors in mind, you can make a more informed decision about whether high-yield municipal bond funds are right for your investment strategy.

Note: As with any investment, the market value may vary during the period the investment is held. This article is informational only and does not a substitute for professional financial advice. Please check with your financial advisor before making any investments. Subject to prior sale and market conditions.